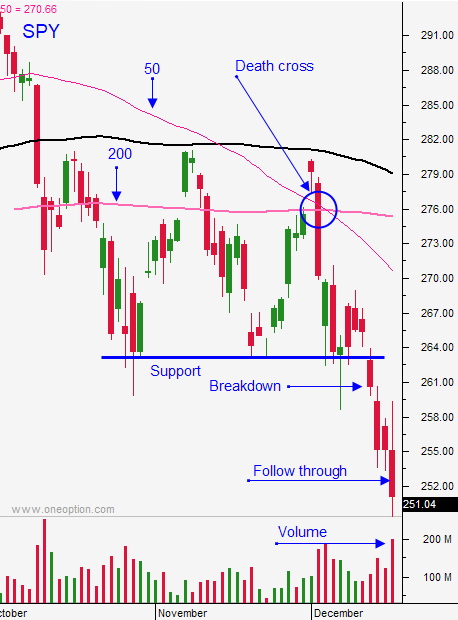

Until You See This Pattern – Short Every Bounce!

Posted 9:30 AM ET - In the last seven trading days the S&P 500 has lost almost 10% of its value. A hawkish Fed, the threat of a Chinese trade war, soft earnings guidance and a government shutdown has spooked investors. The technical damage is severe and this drop will take many months to form a base. Trading programs and margin calls have added fuel to the fire and this selloff is very over-extended. Without question we are due for a snap-back rally.

Every opening rallies have been selling opportunity and the bounce this morning is likely to fail. The long red candles on the chart show that the highs of the day are established early and the market tanks into the close. This is a very bearish pattern and the late day selling has to end.

The Fed is not going to change its policy in the next couple of months. This battleship set sail a couple of years ago and it is difficult to turn.

US trade talks with China will resume in January, but an agreement is many months away. Trump watches the market and the recent drop should soften his rhetoric. The PBOC plans to reduce reserve requirements and China has mentioned a fiscal stimulus program. They will need it. Their PMI next week will be light. Buyers of Chinese goods hoarded inventory ahead of likely tariffs and these supplies need to be worked off.

The government shutdown is likely to last. Trump promised his voters that he would build a wall and he is making a stand. He wants Americans to know that he wants border security and that Democrats don't.

The market will bounce, but from what level? At a forward P/E of 14, stocks are cheap. Earnings growth rates (comps) will be tough because the tax cuts were implemented a year ago. However, profits will hit record levels.

Swing traders should remain on the sidelines until we see this pattern. I am watching for a deep intraday low and an early (before noon) reversal where the market finishes in positive territory with late day buying. The next morning I want to see a higher open and a grind higher with buying into the bell. If I see this pattern I will play the bounce. My size will be smaller than normal and I realize that this move will ultimately result in a good shorting opportunity. The factors I've mentioned above will take months to play out and the bounce will be temporary. Short covering will fuel the move. It will take many months for the market to form a base. We will need trade deals, a more dovish Fed, stable economic growth and solid earnings.

Day traders should look for an opportunity to fade the early bounce. This is been a very profitable tactic. The market won't head higher until the downside is tested. I am shorting rallies and I am not buying dips. Until I see the pattern I referenced above every bounce is a short. I needed to see that capitulation low before I try the long side.

Swing traders should avoid this volatility and day traders should favor the short side until we see that reversal.

.

.

Daily Bulletin Continues...