Ride the Market Momentum – Use Intraday Trailing Stops

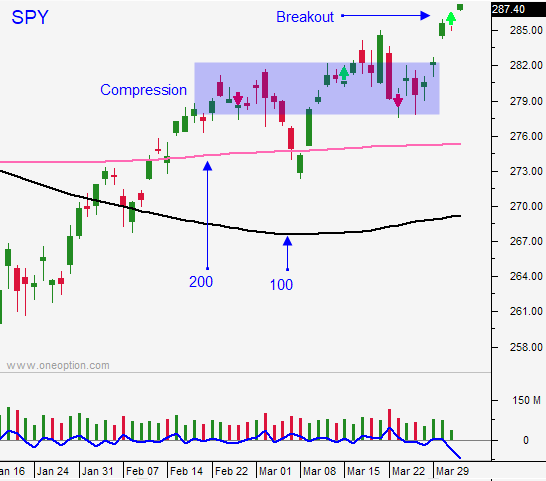

Posted 9:30 AM ET - The market is moving higher after consolidating gains for a month. It has moved through major horizontal resistance and it is 2% from the all-time high. Ride the momentum, but use tight intraday stops. Any surprise favors the downside.

Trade negotiations with China are going well. Officials said that 90% of the deal is in place. Implementation and enforcement are currently being negotiated.

Theresa May is going to reach across the aisle to find a soft exit deal that might include a British membership in a customs union with the EU. This will not resonate with her conservative supporters. May is also considering a longer delay. A Brexit negotiator for the EU (Michael Barnier) said, "as things stand now, the no deal option looks likely." Europe is fed up and they do not want to facilitate member who want to leave the union. England's indecision is going to come at a price.

Trump is threatening to shut down the southern border with Mexico if they don't stop the migrant caravan's. Trade officials are considering ways to keep the trucking lanes open.

China's PMI came in better than expected and that boosted stocks on Monday.

ISM manufacturing was better than expected (55.3), but retail sales fell .2%. ADP reported that 129,000 jobs were created in the private sector during the month of March. That is below the 178,000 jobs that were expected and it is a considerable drop from 197,000 reported in February. ISM services will be posted 30 minutes after the open and it is an important number. The jobs report Friday will also be important. Traders want to see a substantial rebound from the 20,000 number that was posted a month ago.

Earnings season will start in two weeks and that is typically bullish for the market. Stocks are trading at the upper end of their valuation range so we need to watch for pre-announcement warnings.

Swing traders are long a half position of SPY at $285.50. Use an intraday stop of $284. I still don't trust this rally and I feel that investors are overly optimistic. One good number from China does not make a trend. Europe and Japan are weak. A hard exit for England is very possible and they should expect a tough response from Europe when they ask for an extension.

Day traders should wait for this gap higher to settle down (and it could reverse). After back-to-back rallies we can expect some selling on the open. Once support is established, buy the dip. Intraday trading ranges have been very compressed. Focus on stocks with relative strength.

Ride the momentum and keep raising your stops as the market moves higher.

.

.

Daily Bulletin Continues...