Jobs Report Friday Needs To Rebound

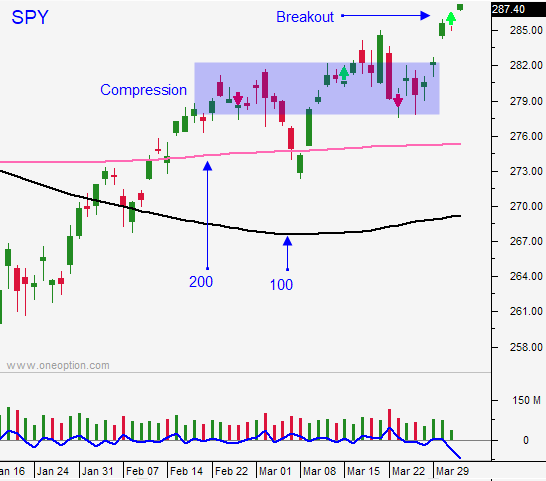

Posted 9:30 AM ET - I am going to keep my comments brief this morning because the news is light. The stock market rally is fueled by momentum and investors are pricing in positive outcomes for looming issues. The S&P 500 is above major horizontal resistance and it is only 2% from the all-time high. Yesterday we saw a little profit-taking late in the day and that suggests resistance.

ISM manufacturing was better than expected, but retail sales, ISM services and ADP were light. Tomorrow we will get the jobs report and traders will be looking for a robust bounce off of the dismal 20,000 number last month. As long as soft economic conditions stay abroad, investors will embrace current price levels.

China's PMI was better than expected, but that is one number and the improvement was marginal. Investors are hoping that extremely accommodative fiscal and monetary policies are starting to bear fruit after a year. Trade talks with the US continue and officials are haggling over the implementation and enforcement of the agreement. Trump says that he will keep tariffs in place to ensure that China honors the terms. This will not resonate well with China.

Europe said that it will not negotiate a trade deal with the US and France continues to withhold its consent. Trump will impose tariffs now that talks are reaching the final stages with China.

Brexit is not going well. Parliament voted (313 to 312) to prevent a no deal exit. This margin is razor thin. Next week England will go to Europe and ask for an extension. The EU is not in a bargaining mood.

Earnings season will start in 10 days and stocks are at the upper end of their valuation range. Good results are priced in.

Swing traders are long a half position and we will use an intraday stop of SPY $285 (just below our entry price). We will try to ride the momentum, but our safety net will always be in place. I still feel that the market is overly optimistic and that there are many dark clouds that could produce lightening. If the SPY trades below $281 we will take a full short position.

Day traders should tread cautiously on the open. The market is flat and we saw some profit-taking yesterday. I believe that we will see two-sided action and good volatility today. Use the first hour range as your guide.

The jobs report tomorrow will be important and we need to see a number well above 100,000.

.

.

Daily Bulletin Continues...