Jobs Rebound and Market Momentum Is Strong – Raise Stops

Posted 9:30 AM ET - This has been a strong week for the market. It has been moving higher on positive economic numbers from China and constructive trade negotiations. Domestic economic releases have been mixed and the jobs report this morning was back on track.

The US and China have completed 90% of the trade negotiations according to officials. They are hashing out the implementation and enforcement. Trump believes that they will have a deal in the next month. He also said that he plans to keep tariffs in place as an insurance policy.

China's economic numbers improved slightly and the market rejoiced. Easing by the PBOC, fiscal spending and a reduction in value added taxes could be bearing fruit. China has thrown the "kitchen sink" at declining economic activity and traders are hoping that the lows are in. One number does not make a trend and the improvement was marginal. I feel that China could be padding its numbers during the final stages of trade negotiation.

Economic conditions in Europe are weak. Germany narrowly escaped a recession and bond yields fell into negative territory last week. Italy is officially in a recession.

Domestic economic releases have been mixed. ISM services, retail sales, durable goods and ADP were light. ISM manufacturing exceeded estimates. In aggregate, all of these numbers are strong. We need to watch for signs of deterioration. The jobs report this morning came in at a solid 191,000. That was the rebound traders were expecting and hourly wages increased a benign .1%.

Brexit is in a continual flux. There were more than eight proposals voted on by Parliament and none of them passed. A vote to prevent a hard exit did pass by one vote (313 versus 312). I am also reading conflicting comments from the EU. One official said that it looks like England is heading for a hard exit and another said that a one-year extension might be granted. At this stage the market is ignoring all of the noise.

Trump is threatening a 25% auto tariff on Mexican cars. He wants our southern border secured and he might use this tactic to coerce Mexico. Speaking of auto tariffs, Europe does not want to negotiate a comprehensive trade deal with United States as promised by Claude Juncker in October. I expect auto tariffs to be placed on European cars as well and that news could come out at any time.

Earnings season will start next week and the market is trading at the upper end of its valuation range. We have to be mindful of pre-announcement warnings. Samsung expects to post a 60% decline in operating profit due to fading memory chip demand and declining smartphone sales.

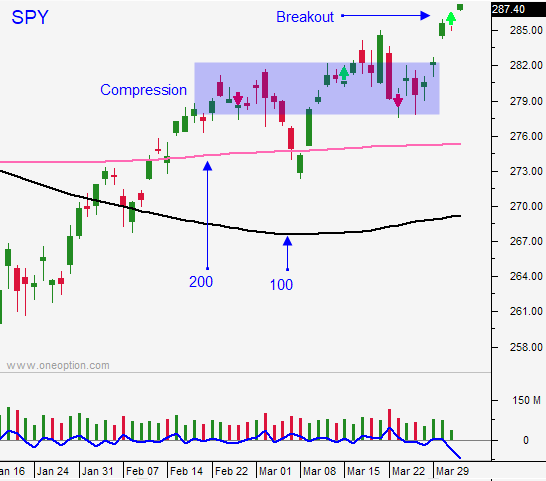

Swing traders are long a half position of the SPY and we will use $286 as an intraday stop. We will keep raising our safety net as the market moves higher. Stocks are within 2% the all-time high and momentum is fueling this move.

Day traders need to be patient during the first hour. Opening gaps higher have been faded. Make sure the gains hold before you start buying. We've seen a pattern of opening gaps higher, a drop and then a rally off of that low for the remainder of the day. Another less common pattern starts with a gap higher and the gains hold. Then it gradually climbs in a very compressed manner. In both cases it is prudent to wait on the sidelines for the first hour.

The news has generally been good this week. Ride the momentum and keep raising your stops.

.

.

Daily Bulletin Continues...