New Trade War About To Begin – Watch the Brexit News

Posted 9:30 AM ET - The news is light and that favors the upward momentum. Buyers are optimistic that earnings will be good and major banks start reporting on Friday. The headwinds are blowing and the S&P 500 is only 2% below its all-time high. Investors are pricing in positive outcomes for all of the issues that loom.

A trade deal with China looks likely and officials on both sides are optimistic as they hash out the remaining 10%. I've been mentioning for weeks, Trump will go after Europe. Yesterday Robert Lightheizer said that the US has been litigating unfair European tariffs for 14 years and it's time for action. Claude Juncker promised a comprehensive trade agreement last October and there has been zero progress. European officials have stated publicly that they are not interested in a free trade agreement with the US.

EU member nations will gather tomorrow for an emergency vote. They will determine whether to grant the UK an additional Brexit extension. Investors have been pricing in an extension and there is a chance (20%) that it won't happen. Europe is fed up with England's indecision and lack of unity. The EU took a hard line when the last extension was granted. A no deal exit will lead to wild currency moves and it could impact credit markets. You must use intraday stops!

Last week the market rejoiced when China's official PMI inched higher. The improvement was marginal and it is only one number. Investors instantly assumed that fiscal and monetary stimulus is bearing fruit and that the lows are in. I am not that optimistic and I believe China padded the numbers during the final stages of the trade negotiations. Asian economic activity has been very soft. The IMF is scheduled to update its world economic outlook. In January it predicted the weakest pace of growth in three years.

Domestic economic growth is stable, but ISM services, ADP, durable goods and retail sales came in light of week ago.

Banks will kick off earnings season on Friday. Stocks are trading at the upper end of their valuation range (forward P/E of 16.5) and analysts have warned that this could be the first quarter of contracting profit growth since 2016. The bid should remain strong until mega cap tech stocks have reported.

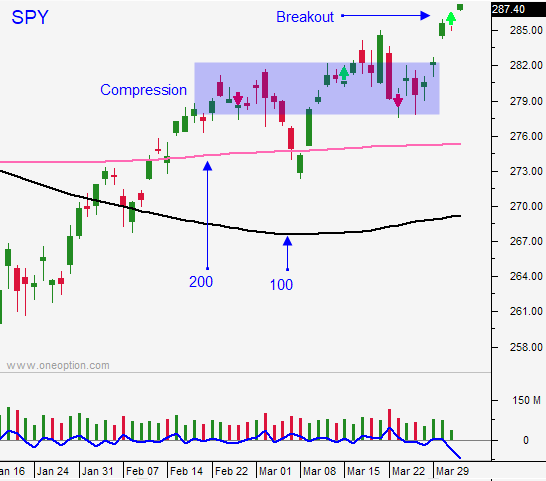

Swing traders are long the SPY at $285.50. We are going to use an intraday stop of $285. Brexit is critical and a hard exit would spark selling. On the other hand, an extension would fuel a small move higher. We only have a half position so I'm not overly concerned. If the market drops on this news we will be ready to stop out and pivot. The most likely scenario is a short-term extension and a decent reaction to earnings for the next two weeks.

Day traders should wait for early selling to run its course. Buy once support is established. This tactic has worked incredibly well for the last two weeks. Sellers test the bid early in the day and the market grinds higher into the close.

We will trail our stop higher and we will be ready to exit intraday if conditions warrant. The market has priced in positive outcomes for all of the issues I've outlined and surprise favors the downside.

.

.

Daily Bulletin Continues...