Brextension and FOMC Minutes Should Be Market Friendly

Posted 9:30 AM ET - Yesterday the market took a breather and we saw late day selling for the first time in weeks. The headwinds are blowing as we approach the all-time high. Earnings season will start Friday and the expectations are high.

Reuters reported that profit margins will contract for the first time in years due to rising costs. Stocks are trading at the upper end of their valuation range and good news is priced at. Buyers are typically engaged through mega cap tech earnings announcements so the bid should be firm.

The FOMC minutes will be released this afternoon and they should be market friendly. The Fed was extremely dovish during the last meeting (no rate hikes in 2019 and the end of balance sheet reduction in Sept).

Today European officials will grant an extension to England. Most analysts believe that the extension will force England to agree that the current terms are not negotiable. The deadline will be extended by as much as a year, but England can depart earlier if Parliament unifies.

Italy will not meet it's budget as promised. Deficits will reach 2.4% of GDP (2% promised) and we will see how the EU reacts. Economic conditions in Europe are very weak.

The trade deal with China is progressing and the final 10% (implementation and enforcement) should be completed in May. The US will begin trade negotiations with Japan next week. Canada is threatening to impose new agricultural tariffs and the new agreement (MCA) will have a tough time getting through Congress. Trump will go after Europe soon as the agreement with China is signed.

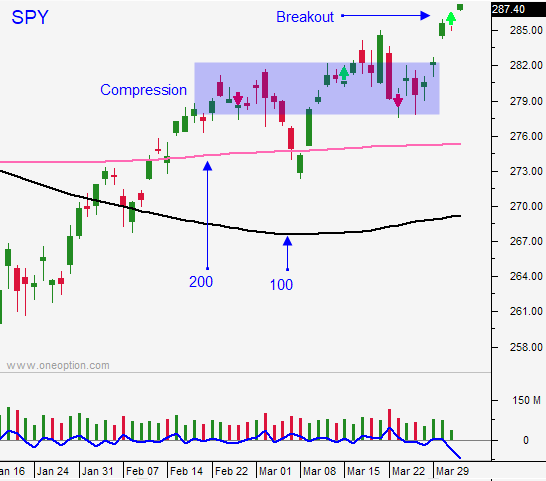

Swing traders are long a half position of SPY. Use an intraday stop of $285. England is likely to get an extension and the market will grind higher into earnings season. If the momentum stalls and the reaction to earnings is muted, we will take profits. I still believe that the market is pricing in positive outcomes and I believe that surprise favors the downside. Global economic conditions are soft.

Day traders should try to short early in the day. The bid will be tested after yesterday's decline and the market will NOT be able to move higher until we find support. Once support has been established, favor the long side.

China's trade numbers on Friday will be important. They will confirm/reject the notion that conditions are improving. The small uptick in China’s PMI last week sparked the last leg of this rally.

.

.

Daily Bulletin Continues...