Nasty Market Decline Ahead – Watch These Support Levels

Posted 9:30 AM ET - I posted a video Friday and I am going to keep the special offer for Option Chat up for another hour. Save 35% and join for just $499/year. CLICK HERE TO JOIN

Last week the market drifted lower on US/China trade tensions. China reneged on prior terms and Trump imposed new tariffs. Vice Premier Liu shortened his trade meetings and the tone is starting to sour. Analysts were expecting a trade deal last week and the market reflected that. Surprise favors the downside and the S&P 500 is off 60 points before the open.

China has not retaliated, but they will. Agricultural products are in the crosshairs. Trump promised farmers that he would use tariff proceeds to purchase grain for redistribution in underdeveloped countries. The humanitarian "spin" sounds great, but farmers will take a hit and they are one of Trump's strongest bases. Trump said that China should strike a deal now because the terms will be much tougher after he wins the 2020 election. He is the first president to stand up to China in decades. Xi wants someone else in power and I believe we will NOT see a trade deal before the election.

In addition to other tactics, China has been using North Korea as a pawn. They control Kim Jong-Un and they will promise to keep him in line in exchange for trade concessions. It is no coincidence that North Korea is launching missiles during this critical stage of trade negotiations (he was instructed to).

China's economic numbers are not rebounding as most analysts expected. Fiscal and monetary stimulus did not have the expected impact and activity in April declined. China will report industrial production and retail sales this Wednesday. Xi does not have to worry about re-election. He will maintain his image of strength even if it results in an economic slowdown.

Wednesday will be the key economic day. Europe will release its GDP and US retail sales will also hit the wires. A potential trade war with China and soft economic numbers would spark selling.

Earnings season is winding down and the results were good, but not good enough to spark a sustained rally. Stocks are trading near the upper end of their valuation range.

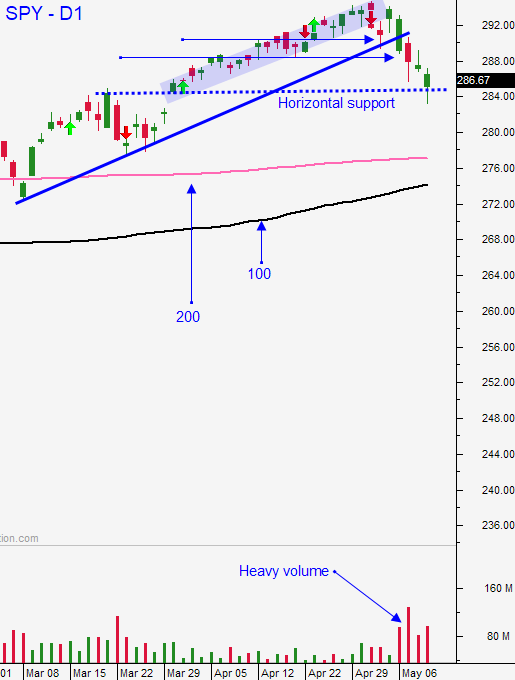

Swing traders should remain in cash. The bid has been fairly strong to this point and major declines have been gobbled up. We saw a nice reversal off of the low Friday. That move was premature and traders felt that US/China trade relations would remain cordial. The rhetoric over the weekend suggests otherwise. The S&P 500 is likely to test the 200-day MA after China retaliates. We might even see a move down to SPY $275 (100-day MA). I don't want to short the market on such a huge decline this morning. If the selling gains traction we will look for a better entry point this week. I would like to see higher opens and lower closes. These big drops early in the day have been bought.

Day traders need be patient this morning. The selling will be heavy and the S&P 500 will be volatile. I suggest shorting stocks that have exposure to China. CAT, AAPL and BA might be worth a look. We will find candidates using Option Stalker. Focus on stocks with relative weakness that have already breached major support. I will not trade the S&P 500 unless we get a nice early bounce that I can short. The other possibility would come later in the day if I see multiple support (double bottom or higher low). In that event I would trade from the long side.

There is minor support at $279. Major support is at $277 and $275. Resistance is at $285 and $290.

.

.

Daily Bulletin Continues...