Day Traders Watch For This Move Early – Swing Traders Stay In Cash

Posted 9:00 ET AM - Yesterday the S&P 500 fell more than 70 points and it closed near its low of the day. Trade negotiations with China are strained and both countries imposed new tariffs. Investors expected a trade deal and surprise favored the downside. Stocks will open a little higher this morning, but the downside will be tested.

In a statement Trump said that he still believes a deal can be reached in the next few weeks and he plans to meet with Xi at the G20 meeting in June. This calmed nerves and overseas markets are trading a little higher.

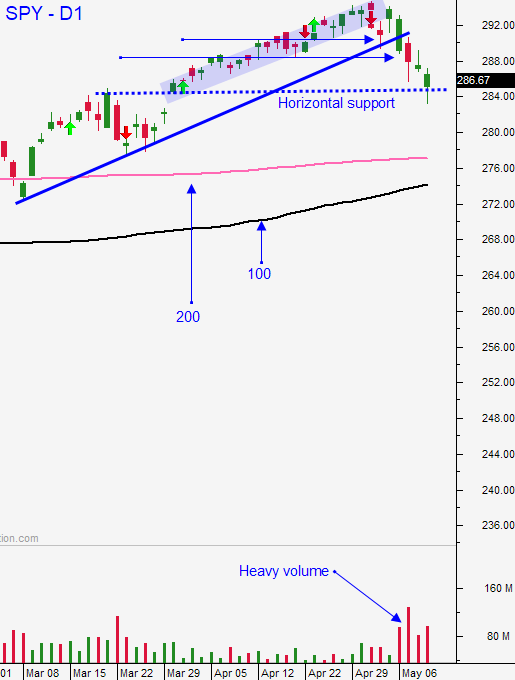

After a heavy round of selling we will see support tested this morning. Investors will be watching the next few weeks to see if the rhetoric escalates. During that time I expect to see the 200-day moving average tested.

China will post industrial production and retail sales overnight. China's economic activity dipped slightly in April and analysts were looking for a rebound. Massive fiscal and monetary stimulus in the last year did not bear fruit and China’s manufacturing is just above the contraction level.

Europe will post GDP Wednesday morning and their growth has been dismal (.4%).

US retail sales will be released tomorrow before the open and we will be able to gauge consumer spending.

Earnings season is winding down. Stocks are trading at the upper end of their valuation range (forward P/E of 16) and strong profits were not able to generate a sustained rally through the all-time high.

Swing traders should remain in cash. Global economic growth (or the lack thereof) is a greater concern than US/China trade negotiations. I want to gauge economic releases during the next few weeks and I believe we will have an opportunity to buy at lower levels.

Day traders should look for shorting opportunities early this morning. Wait for the bounce to stall and search for stocks with relative weakness on the opening bell. After a heavy round of selling yesterday some Asset Managers will still be reducing risk. Buyers will not step up until they know the bid has been tested. The market typically rests after a big day. I suspect that we will fall into a tight trading range once support is established. Use the first hour range as a guide.

The high from Monday is resistance and the low from Monday is support. SPY $277 is a major support level (200-day moving average).

.

.

Daily Bulletin Continues...