Market Selling Will Resume Today After Dead Cat Bounce

Posted 9:30 AM ET - Yesterday the market tried to recover some of the hefty losses from Monday. The market gapped higher and the bid was steady for most of the day. Sellers surfaced late in the day and stocks closed on a whimper. This morning the S&P 500 is down more than 16 points before the open. Trade wars and global economic uncertainty are shaking investor confidence.

China and the US imposed new tariffs and the rhetoric has been inflammatory. Analysts were expecting a trade deal last week and the negotiations have stalled. Yesterday Trump said that he still believes a deal is possible and he plans to meet with Xi during the G20 meeting in June. This news sparked a small round of buying Tuesday.

I mentioned in my comments yesterday that global economic conditions were much more important than a trade deal. All of the focus has been on the US/China negotiations and the decline in global economic activity has almost gone unnoticed. China launched a massive fiscal and monetary stimulus program a year ago and an economic rebound was expected. Activity increased in March and analysts predicted that the lows were in. Unfortunately for China, April's numbers were soft and that trend continued in May. A trade deal with the US will slow this trend, but it won't stop it.

This morning China reported that industrial production rose 5.4%. That was less than the 6.4% that was expected and it matches November's number (the lowest level since the financial crisis 10 years ago). Retail sales increased 7.2% year-over-year and that was the weakest pace since 2003. Fiscal and monetary stimulus during the last year is not bearing fruit.

Germany rejoiced that Q1 GDP grew a dismal .4%. That number was released overnight and it was better than expected. Japan's Q1 GDP is on par with Germany's miserable results.

This morning we learned that US retail sales declined .2% when an increase of .4% was expected. Investors seem willing to hold stocks as long as domestic economic releases are stable. Sooner or later the US will be impacted by the weak global backdrop.

Earnings season is winding down and the results were good. Stock valuations are near the upper end of the range and the market could not generate a sustained rally through the all-time high.

The Fed is dovish because global risks are increasing.

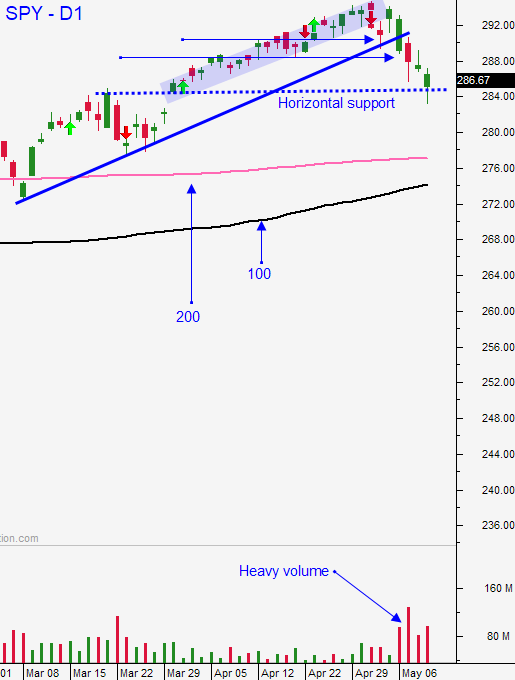

Swing traders should remain sidelined. I believe the 200-day moving average will be tested very soon. We are not likely to breakthrough on the first attempt and we can expect a couple of bounces off of that level. The overnight news was not good, but it was not devastating. We need to see if US/China trade negotiations improve in the next few weeks. Both sides were negotiating the final 10% of a trade deal (implementation and enforcement) and we need to see if relations improve. If the market rallies on a trade deal and if global conditions continue to deteriorate an excellent shorting opportunity will surface. The market has been in a very strong uptrend this year and it will be hard to turn. Consequently, we don't want to short the first dip.

Day traders are much more nimble and this is a good shorting opportunity. Yesterday's move was a "dead cat bounce". The selling momentum has increased in the last two hours. The S&P 500 was down six points when I turned on my computer screen and it has dropped an additional 12 points in the last two hours (pre-open). Support is the low from Monday and resistance is the high from yesterday. I believe that we will challenge the 200-day moving average in the next week. Yesterday I suggested running an early search to find relative weakness. It was easy to spot since the market gapped higher. Those stocks will be prime candidates this morning. We use Option Stalker searches to find these stocks.

The selling momentum this morning has been picking up. Short weak stocks on the open.

.

.

Daily Bulletin Continues...