Market Rally Has Stalled – Range Likely This Summer

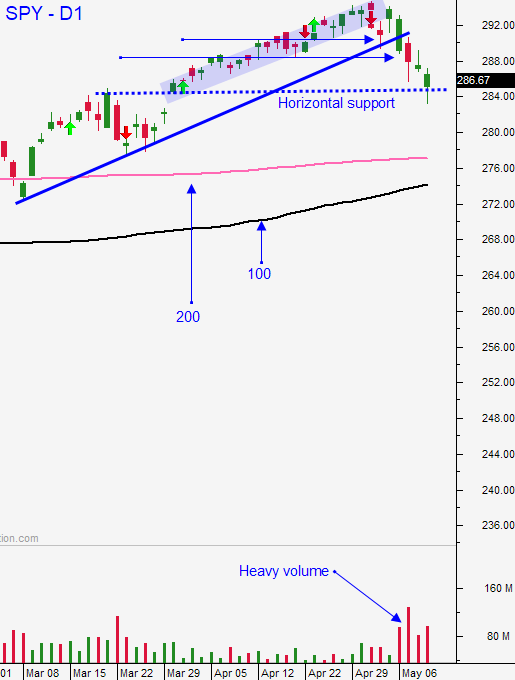

Posted 9:30 AM ET - The market has been very resilient and the bid is strong. Yesterday we had a negative round of news and stocks weathered the storm. The S&P 500 was down 20 points on the open Wednesday and the low was established immediately. We did not get close to the low from Monday and that is a good sign. As the day unfolded buyers stepped in and the market closed near its high. A bullish engulfing pattern can be seen on the daily chart and we have follow-through this morning. The SPY will open above the $285 support level.

US/China trade negotiations have temporarily soured and both countries have imposed new tariffs. Trump said that he plans to meet with Xi at the G20 meeting in June so all hope is not lost. Talks will continue next week.

Yesterday a rumor circulated that Trump will postpone the European/Japanese auto tariffs by 6 months if they agree to reduce auto exports to the US. That announcement will be made before midnight Friday. The market shot higher on this rumor Wednesday. There is no way the EU or Japan will agree to this, but investors only care about the here and now. As long as the tariffs are postponed it reduces uncertainty and that is good for the market.

Trade negotiations with Canada and Mexico are also improving and it is rumored that a trade deal with Japan is close.

The economic news yesterday was weak. China's industrial production and retail sales missed expectations and both dropped to levels not seen in a decade. Germany's Q1 GDP increased a miserable .4%. Japan's GDP is at about the same level. The greatest market threat is a global economic contraction.

Retail sales in the US dropped .2% and an increase of .4% was expected.

The market has been able to shoulder all of the negative news and it did not get close to testing the 200-day moving average before buyers stepped in (bullish sign). Yesterday's reversal was also impressive. The market has been in a very strong rally since January and that trend will be hard to turn. It will take many negative economic releases this summer to spark selling. I will be watching for a lower high.

Swing traders should remain in cash. Stocks are trading at the upper end of their valuation range and the upside is limited. The positives and negatives are balanced and the market is likely to stay in a trading range. It doesn't make sense to have exposure when negative news is mounting.

Day traders should take advantage of these large intraday swings. I will wait for the bid to be tested this morning. Once I'm confident that buyers are still engaged, I will trade from the long side. We've seen nice movement in both directions. Use the first hour range as your guide and lean on $285 support. We have been using Option Stalker searches in the chat room and we nailed FB early yesterday. We will find similar today.

.

.

Daily Bulletin Continues...