No China Trade Deal Until 2020 Election – Here’s Why

Posted 9:30 AM ET - The market fell hard Monday and it spent the rest of the week trying to recover. Yesterday we filled the gap from Monday, but buyers threw in the towel late in the day. Harsh overnight rhetoric from communist controlled Chinese media has unnerved investors. The S&P 500 is down 20 points before the open.

A team of US trade officials will go to China next week to continue negotiations. "The Street" has priced in a deal and any surprise favors the downside. A trade deal will not be signed before the 2020 elections. China has been playing games with the US from the start. I believe they brought Kim Jong-un to the table as a bargaining chip to years ago. First they instruct him "make nice" with Trump and China demonstrates that they control his actions. As trade negotiations become strained they orchestrate a meeting between Kim Jong-un and Trump in Singapore that they know will fail. China puts itself in a position to play the "white knight" and when US trade negotiators continue to take a hard line they instruct North Korea to launch missiles. China accounts for 90% of North Korea’s trade and they have total control. When the missile launches fail to soften our stance China reneges on terms that they already agreed to. Trump is the first president in decades to stand up to China and they don't want him to be reelected. These trade negotiations will drag on into 2020.

China already sees itself as the world leader. They feel that they can shoulder a round of economic contraction and according to the overnight headlines "this will make China strong". On the surface it would appear they have the upper hand since their GDP is growing at a 6% clip. The problem with decades of hyper-growth is that it spawns inefficiency and many industries would not survive without government subsidies. China's shadow banking industry (unregulated) equals our nation's $21 trillion debt. Nomura (Japanese bank) estimates that Chinese corporate bond defaults were four times greater in 2018 and they were in 2017. Many analysts believe that China is a house of cards.

China has thrown the kitchen sink at their economy. Fiscal and monetary stimulus was expected to spark a rebound and it looked like March was the beginning of a leg higher. Economic data points in April and May have been contracting. Xi does not care because he does not have to win an election. China will impose tariffs on agricultural products knowing that Trump's base is in the bread basket of the country.

I've spent a lot of time on the US/China trade negotiations this morning because it is driving the market. My trading time horizon is very short-term so I don't focus heavily on fundamentals. However, I am fully aware of the backdrop and I believe the market has this wrong. Even if a trade deal with China is reached, it won't stop the global economic backslide. The largest economies in the world (China, Japan, Germany, England and France) are slipping.

There are a couple of fundamental forces that always keep a strong bid to the market. Global interest rates are near historic lows and investors are forced to hold equities just to keep up with inflation. Secondly, corporations have cut outstanding shares in half during the last decade through share repurchase programs. That means that the same amount of money is chasing fewer shares and that drives stock prices up. Unless we have a full-blown credit crisis you can expect a decent bid to the market. We might see an occasional 20% correction, but that would be the extent of it.

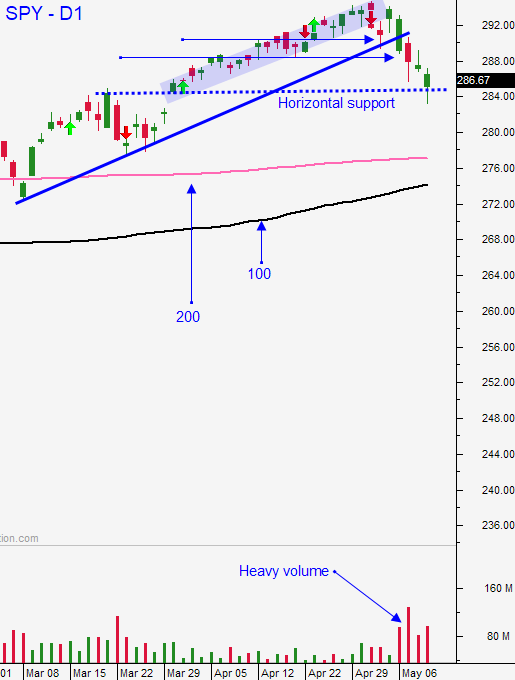

From a technical perspective you can't short a massive rally that has lasted four months. Picking tops is a great way to lose a lot of money. I need to see technical support breaches and sustained selling before I can take a short position. I believe that the bounce this week will reverse and the market will challenge the 200-day moving average in the next few weeks.

Swing traders should remain in cash. We will wait for a nice decline and we will be ready to buy.

Day traders should rejoice. This is the best trading environment you can hope for. Intraday ranges have been wide and we are seeing big overnight moves. We use proprietary searches to find relative strength/weakness and we are making great money in the chat room. I don't see the point of carrying overnight positions in this environment. We are able to capture most of the moves without the risk. Some days we get big moves in both directions.

Look for selling pressure throughout the day. Support is at SPY $285 and you can use that as your guide. The low of the week is also support. The high from yesterday is resistance.

.

.

Daily Bulletin Continues...