Market Will Digest Gains This Week While It Waits For G20

Posted 9:30 AM ET - Last week the market broke out to a new all-time high and it is pricing in best case scenarios. Trump and Xi will meet this weekend, but that doesn't mean that relations are improving or that trade negotiations will escalate. The FOMC removed the word "patient" from its statement, but it did not hint that is leading towards a rate cut in July during the press conference. Traders will go with the flow as long as the breakout holds.

You know from my comments that I'm very skeptical about a US/China trade deal before the 2020 election. Fiscal and monetary stimulus by China suggest that they are preparing for a prolonged battle. Geopolitical pawns (North Korea and Iran) are also advancing. China controls 80% of the world's rare earth supplies (used extensively in high-tech hardware) and they could use that as a weapon. I hope I'm wrong, but political tensions could increase after this meeting.

The Fed takes its cue from the market. Officials will flat out deny that they base policy off of the market, but its a fact. With the market making a new all-time high they will not ease. Investors will grow impatient, the market will drop and then they will take action. I believe September is the earliest we will see a rate cut and it will only happen if there is market weakness.

Global economic conditions continue to deteriorate. The economic news is fairly light this week (durable goods and GDP). A week from today official PMI's will be posted and the economic news will ramp up throughout a holiday shortened week (ISM manufacturing, ISM services, ADP and the Unemployment Report).

This should be a fairly quiet week. All eyes are focused on the G20 meeting this weekend. The rhetoric should be "friendly", but I will pay more attention to the trade negotiation meetings. If more meetings are scheduled, that would be a positive sign. If fewer meetings are scheduled, that would be bearish. China's PMI will also be known Monday morning and we could see a big overnight move.

Stocks are trading at a forward P/E of 17 and they are at the upper end of their valuation range. It will be hard for them to advance without good news and the chance of additional tech warnings (BRCM) are possible. This morning Daimler lowered its guidance for the third time this year.

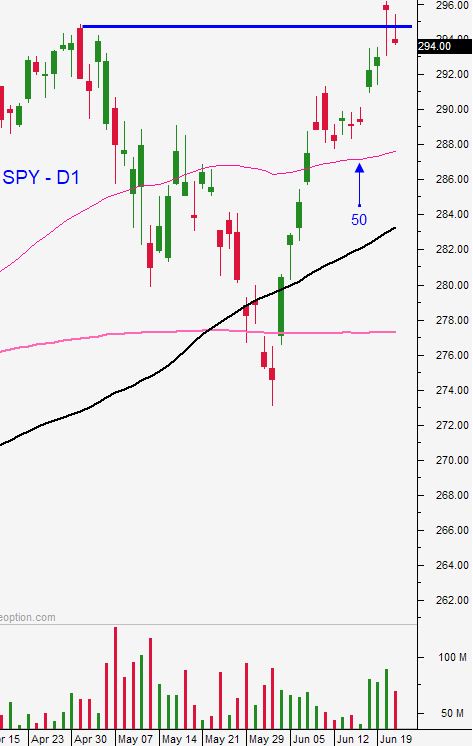

Swing traders should wait on the sidelines until this news plays out. Resistance is at $294.70. While the breakout looks like it failed, it's important to remember that a dividend of $1.43 was paid Friday. This morning the market will open above that breakout.

Day traders should focus on the long side this morning. The breakout last week suggests that buyers are still engaged and latecomers will buy any dip. Try to make your money early in the day and watch for a trading range to set in. If that happens can try a few scalps - fade the extremes. If the futures are in a tight range, focus on stocks with relative strength.

The G20 meeting is all that matters right now and I'm expecting a low volume week.

.

.

Daily Bulletin Continues...