Market Will Be Dead Till the Fed – Breakout Today Unlikely

Posted 9:30 AM ET - Yesterday the S&P 500 tested the all-time in it was not able to get through on the first attempt. This morning it will try again. Investor concerns have temporarily been pacified and global bond yields are at historic lows forcing money into equities. I will be looking for a buying opportunity next week.

Trade negotiations with China have stalled. Both sides will try to stay at the negotiating table to keep investors calm. There will not be a trade deal before the 2020 election and it might not matter. Both economies are still on sound footing and consumers are not feeling the pinch (higher prices).

Brexit has been postponed until January 31st and that had the potential to be a major market disruptor.

Central banks around the globe are easing like mad. The ECB cut interest rates by .1% (now-.5%) and they will restart QE (€20 billion) in November. The market is pricing in a .25% rate cut by the Fed next week and most analysts are expecting at least one more rate cut this year. Short sellers will be passive ahead of the FOMC statement next Wednesday.

Earnings season will start in a couple of weeks and we have not heard any major warnings. At a forward P/E of 17, stocks are trading at the upper end of their valuation range and good news is priced in.

Domestic economic conditions are solid. ISM services came in at a robust 56.4 last week and ADP reported that 195,000 new jobs were created in the private sector during the month of August. Solid growth combined with a quarter-point rate cut next week is bullish for the market.

President Trump will keep his trade rhetoric fairly cordial. He wants the market to make all-time highs and that is one of his election battle cries. Republicans and Democrats will raise the debt ceiling in a few weeks - neither party wants to risk a black eye (government shutdown) before the election.

Swing traders should remain in cash. I believe that the Fed might not be as dovish as everyone hopes next week. This could be a “sell the news” event and we will look to enter at that time. The dark clouds temporarily parted, but global economic weakness is a concern. We should see a decent bid heading into year-end. With global bond yields in negative territory investors are forced by stocks. Bond investors lose purchasing power because fixed income returns don't keep pace with inflation.

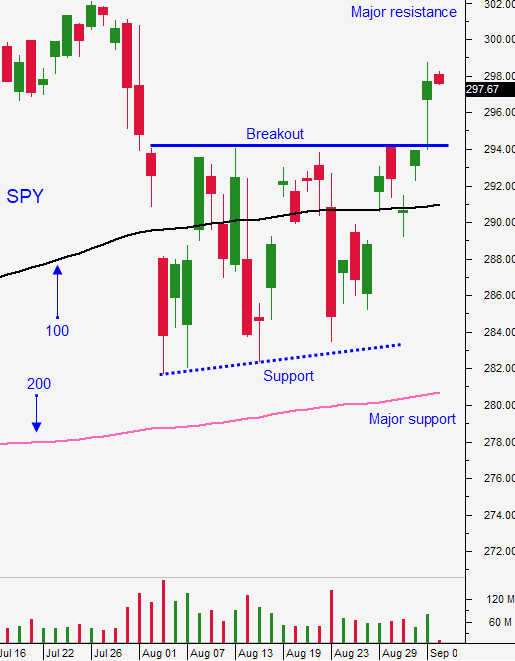

Day traders should watch to see if the market can break through the all-time high. There is resistance at that level and I don't think we have enough momentum or good news to push us through. If we are able to breakout, buy stocks with relative strength that are also breaking out. If the market stalls at the all-time high wait for a pullback and then trade from the long side. The low from yesterday SPY ($300.50) should provide support and that would be an excellent day trading entry point if we test it today.

Look for lackluster trading the next three days while everyone waits on the Fed. The FOMC statement could provide a letdown and we will look to buy any dip. My levels for buying are $297 and $294.

.

.

Daily Bulletin Continues...