Here’s Why I Am A Bit More Bullish – When I Plan To Buy

Posted 9:30 AM ET - The S&P 500 is within striking distance of the all-time high. Trump will delay the next round of Chinese tariffs by two weeks as a sign of "good faith". The ECB is dovish and the market is addicted to easy money. Look for a higher open this morning.

A trade deal with China is not that important. Many analysts believe that there will be a "mini deal" where the US reduces supply restrictions on Huawei and it postpones additional tariffs. In exchange, China will agree to purchase more agricultural products. While this scenario might play well with investors, the outcome puts us back where we were in June. That is not progress. A two-week tariff delay is hardly newsworthy.

The ECB has released its statement and the impact on the S&P 500 is negligible. With interest rates at 0% they have very few weapons in their arsenal. They're likely to reintroduce quantitative easing and dovish policies are already priced in.

The FOMC statement next week will be important. A quarter-point rate cut is expected and many analysts are looking for an additional 50 basis point rate reduction this year. That seems overly optimistic given that domestic economic growth is strong. There is a chance for disappointment next Wednesday.

Here's the bottom line. Trade wars don't matter as long as economic growth in the United States and China are stable. These are the two largest economies in the world and they are the cornerstone to global activity. Central banks are easing and bond yields are near historical lows. Fixed income investments do not keep pace with inflation and they produce negative real returns for investors. As long as credit concerns remain minimal, Asset Managers will be forced to own equities.

There is another force at play. Corporations are issuing debt (raising capital) at a very low cost. They are using those proceeds to repurchase shares. In the last 10 years the number of outstanding shares has been cut in half. When more money (demand increasing) is chasing fewer shares (supply decreasing) stock prices go up.

A hard exit for England was postponed until January 31st and this was a major development. Trump and Xi will pacify investor concerns through year-end, but a trade deal with China will NOT happen before the 2020 election. The debt ceiling/budget will not be an issue. Republicans and Democrats don't want bad press heading into 2020.

With some of the major concerns being postponed, I am more bullish heading into year-end. Stock valuations are at the upper end of their range (forward P/E of 17) so I'm not an overly aggressive buyer at this level.

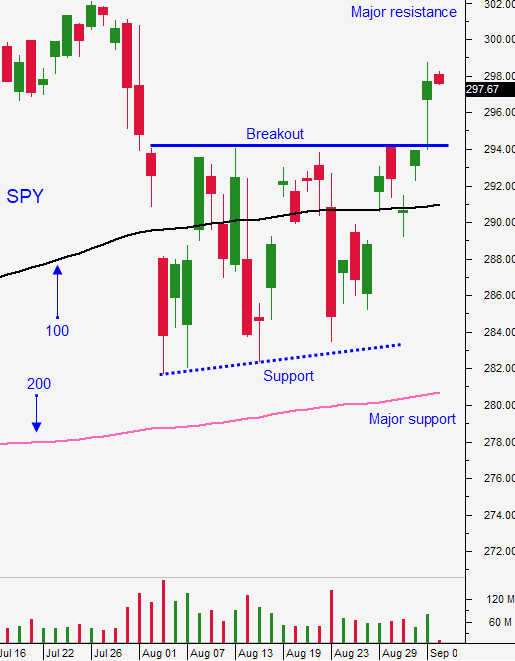

Swing traders should remain patient. I am looking to buy a dip next week after the FOMC statement. I would like to get long at SPY $294, but I would nibble at $297. There is room for disappointment and there should be an opportunity to enter on an FOMC pullback a week from now.

Day traders should trade from the long side today. Wait for the bid to be tested and buy stocks with relative strength once support is established. The market is likely to test the all-time high this week.

Look for positive price action this week and a likely drop after the FOMC statement next week.

.

.

Daily Bulletin Continues...