The Risk of a Market Dip Is Smaller – Here’s the Swing Strategy I Am Using Now

Posted 9:30 AM ET - It's been five days since Trump signed the bill supporting Hong Kong protesters and China has yet to retaliate. This was the greatest potential speed bump and the lack of backlash tells me that China wants a trade truce. President Trump delayed the signing and that tells me that he did not want to muddy the water either. I view this as a market friendly and stocks should be able to float higher on good news.

China's PMI came in at 50.2 and that is the best reading since March. The Caixin/Markit manufacturing PMI came in at 51.8 and that was also better-than-expected.

Domestic economic releases have also been good. GDP (2.1%) was better than expected and so were durable goods orders (.6%). Online sales for Black Friday rose 19.6% and Cyber Monday is expected to grow 18.9% year-over-year. ISM manufacturing will be posted 30 minutes after the open and the economic calendar is heavy this week.

Boris Johnson as a comfortable lead in the polls and that bodes well for a Brexit agreement. This will remove market uncertainty in 10 days.

Democrats are taking heat in the polls for the impeachment hearings and Americans are frustrated that nothing is getting done. This might prompt them to sign the USMCA trade deal and it could boost GDP by 1%. This is a much bigger event than the China trade truce and it would certainly fuel a year-end rally if it is signed.

The market is slightly overbought and forward P/E's are at the upper end of the valuation range (17.5). These forces will provide a headwind we should expect a grind higher (not an explosive melt-up).

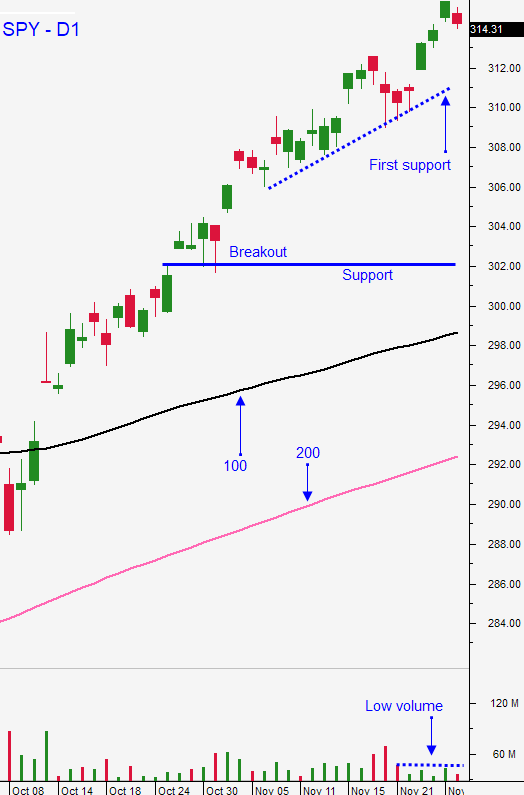

Swing traders should maintain the VXX position for a few more days. China has been surprisingly quiet and it's just a matter of time before they react to the bill signing. We will patiently wait for a dip. Until then, we will selectively sell out of the money bullish put spreads and bearish call spreads. Last night I posted a YouTube video highlighting cheap stocks that want to run. I showed you how to find these prospects using Option Stalker. Option premiums are near the 52-week low and you need to sell credit spreads too close to the money to generate a decent credit. I don't like the risk/reward profile for credit spreads right now. It's also tough to buy premium on a swing basis. The market is gradually moving higher and time decay is an issue. For these reasons I like buying cheap stocks for swing trading.

Day traders should expect the bid to be checked every morning. Once traders confirm that buyers are still engaged the market grinds higher. We are seeing the low of the day near the open and the high of the day near the close. This pattern is bullish and it produces green candles on a daily chart. Identify stocks with relative strength early in the day and start buying when the market finds support. Heavy Buying, Relative Strength 30 and PopBull are my favorite Option Stalker searches right now. I am using Custom Search to find stocks that have heavy volume today, trade for less than $10 and that have a bullish ADX reading on a one-hour basis. These prospects have heavy volume and upward momentum. I like breakouts through horizontal resistance on a daily chart. In general, I prefer to day trade stocks that I like on a swing basis.

China's backlash is a potential speed bump, but given the delayed reaction it might not be too severe. I am more bullish than I was a week ago for this reason.

.

.

Daily Bulletin Continues...