Let Your Bullish Put Spreads Expire Friday – Don’t Roll Into January – Gradually Go To Cash

Posted 9:30 AM ET - The market narrative won't change much through year-end. Major events have been resolved and less uncertainty is good for investor confidence. Asset Managers want the S&P 500 to finish the year on its high and they will be bidding for stock. This is a banner year for investors and the index is up 28% since January 1st. I don't see any speed bumps, but we can expect a little profit-taking and a relatively stiff headwind.

USMCA, a Phase1 deal with China, a likely Brexit agreement and a dovish Fed are fueling the rally. These events have all been resolved in the last two weeks.

Stock valuations are fairly lofty at a forward P/E of 18. That does not mean that a market correction is at hand. The market can move sideways while stocks catch up to their valuations. I believe that this rally will run out of steam fairly soon and we will transition into a range.

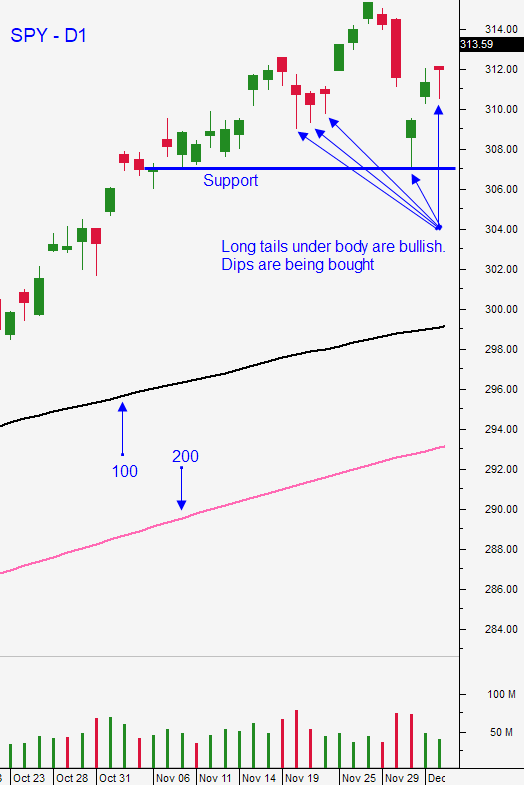

On a daily and a weekly basis the S&P 500 has poked through the upper end of a trading channel. That typically results in a move back below the upper end of the channel. In the next few weeks I'm expecting to see a small pullback.

Swing traders need to set a target of SPY $324. If we get there we will gladly take profits. Many of our bullish put spreads will expire Friday. If the stocks have run hard, don't roll them into January. Reduce your overall exposure and wait for the dip. Stocks that have been weak all year are starting to rally ("the dogs are barking"). This is a sign that this leg of the rally is maturing. In last night's swing trading video I highlighted a handful of attractive bullish put spread candidates. These stocks have gradually been moving higher and they still have upside. They have also moved above major support recently and we can lean on that level for new bullish put spreads. I would suggest only allocating a third of your normal position size at this time. Leave lots of cash on the sidelines and wait for the dip. If your bullish put spread exposure is still fairly high, consider buying VXX as a hedge. Don't give back the gains that we've worked so hard for in the last few months.

WATCH THE WEEKLY OPTION TRADING VIDEO - NEW PICKS POSTED

Day traders should focus on short-term momentum stocks. Try to sell very short term (weekly) bullish put spreads and hold the positions overnight. The market has made small gaps higher each day and then the price action is compressed the rest of the day. This pattern will continue and most of your gains will be made overnight. We are seeing some decent rotation during the day and we have been able to catch those moves using Option Stalker searches. Heavy Volume, Relative Strength 30 and PopBull have been excellent. BullRun has been another great search.

Look for another quiet day. You should be reducing risk this week when you're bullish put spreads expire. Don't add many for January. I plan to be mainly in cash by year-end.

.

.

Daily Bulletin Continues...