Sell Bullish Put Spreads On These Stocks Ahead of Earnings – Market Bid Is Strong

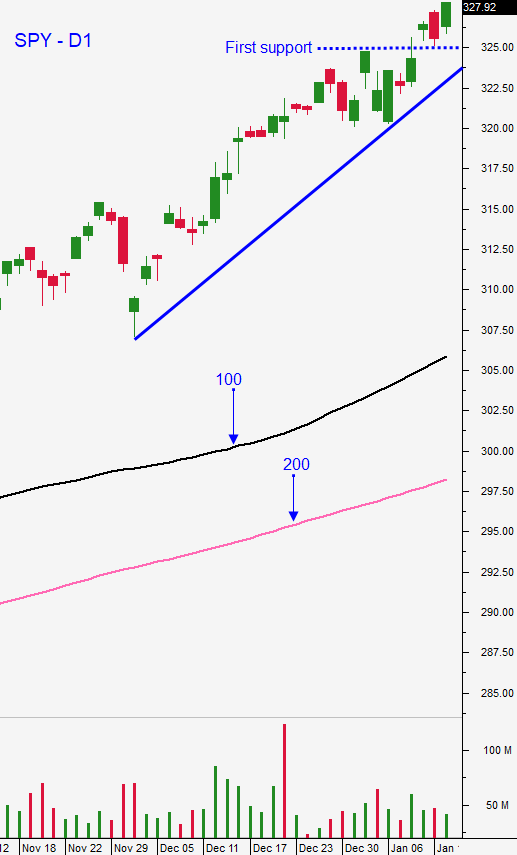

Posted 9:30 AM ET - PRE-OPEN MARKET COMMENTS WEDNESDAY - Yesterday the market pulled back slightly on concerns that the Coronavirus would slow economic growth in China. Those worries have dissipated overnight and the S&P 500 is up 15 points before the open. Earnings season will unfold this week and the releases will climax during the next 10 days.

This is a relatively light new cycle and that favors the current upward momentum. Trade deals will keep buyers engaged and they will wait for mega tech stock earnings releases. Valuations are a little stretched and companies will have to post exceptional numbers to keep the stock afloat. Strong guidance will also be important.

IBM posted good results last night and so did Netflix. Netflix provided weaker than expected guidance and the streaming video market is heating up with competition from Apple, Amazon, Disney and others. International growth for Netflix was strong and domestic growth was weaker than expected.

Earnings releases in the next 24 hours will be fairly minor. Texas Instruments is the most significant company to release overnight.

Swing traders should be doing well on the bullish put spreads that have been sold in the last two weeks. Your risk exposure should be fairly minimal at this stage and you should be entering bullish put spreads on stocks that have a history of rallying into the number. Option Stalker has a search that finds these stocks. In the last week I have posted videos on YouTube highlighting NFLX, WHR, JNPR, IBM and others. All of these trades worked out beautifully and I found them with this search. Historically, the stocks in the Buy Into Earnings search have rallied 2 weeks ahead of earnings during the last three years more than 75% of the time. I am looking for stocks that are resting just above major technical support and I am using this statistical edge to sell bullish put spreads just below that support. The stock can drift a little lower, stay flat or move higher. I will make money in all of these scenarios with this options trading strategy and I have a big statistical advantage. A good market tailwind is also helping. All of these factors increase my odds for options trading success. I am also looking for post earnings plays. I want to see stocks that retrace on fantastic results. If the guidance is good, I will wait for support and that I will sell bullish put spreads below that support. Option Stalker has a great search to find these candidates as well. It is called Strong After Earnings. Tonight I will post my weekly swing trading video to members.

CLICK HERE TO WATCH LAST WEEK'S SWING TRADING VIDEO - SEE HOW THE PICKS DID

Day traders should use the 1OP indicator in Option Stalker to gauge the market. There were a couple of small S&P 500 day trading opportunities yesterday, but there is another way that I like to use the 1OP indicator. When I see big peaks and a bearish crossover, I take profits on my long stock positions. That is a bearish cross and I wait for the market pullback. When the 1OP indicator forms a deep trough and I see a bullish cross, I reload and I buy strong stocks. This is a long only market environment. The action is very one-sided and you should keep your shorts to a minimum. Spend the majority of the day finding stocks with relative strength, heavy volume and momentum. Heavy Buying, Relative Strength 30, Bull Run and PopBull are my favorite searches.

The rally this morning will do one of two things. Either we will pullback and check the bid or we will compress and breakout mid-day. If we take out the opening price in the first hour, stay on the sidelines. It means that some of the gap will fill and you need to wait for support. This will give you an opportunity to run searches like Relative Strength 30. Find the stocks that want to run and when the market finds support, buy them. If the market compresses during the first hour it is a sign that buyers are still aggressive and that the early gains will hold. You can buy stocks with strength if you see this. Eventually, the market will break out and that will fuel your stocks.

I'm not expecting any speed bumps. Expect compressed daily trading ranges. Focus a little more on swing trading options and use bullish put spreads. During the day, be patient and buy dips.

.

.

Daily Bulletin Continues...