First Signs of Selling – Expect More Balanced Market Action – Watch This Support Level

Posted 9:30 AM ET - The S&P 500 will open 5 points lower this morning. There are concerns that the Coronavirus might impact global economic growth, but the selling this morning is more likely resulting from a light round of profit-taking. Yesterday we saw the first signs of selling and the market reversed from an opening gap higher and it closed on its low. This is nothing to be overly concerned about and I expect to see a market pullback in the next few weeks. This dip will provide us with excellent buying opportunities.

The trade deals, Brexit and historically low interest rates are creating a very positive backdrop.

Economic data points have been solid and the news cycle is fairly light.

Earnings season will be in full bloom next week and the early results have been decent. At a forward P/E of 18, many stocks are a little rich and it will be difficult for them to tread water at elevated levels. If the majority of companies have a slight downward reaction it will put pressure on the S&P 500. Apple, Microsoft, Amazon, Google and Facebook account for 18% of the S&P 500 and these stock reactions will be particularly important.

Swing traders should sell out of the money bullish put spreads on stocks that have reported strong earnings and that have pulled back to technical support levels. This will be our option trading strategy for the next month. Last night I posted my weekly swing trading video and I found six nice bullish put spreads. Start easing in and focus on post-earnings plays.

Day traders should take notice. Yesterday's price action was a little bearish and we might see two-sided movement from this point forward. I'm not expecting a big market drop, but the headwinds will start blowing. I still favor allocating more money to long positions on market dips. I have been using half as much money on shorts. If I see additional late day selling and I will start to take a more balanced approach during the day. Let the market come in this morning and wait for signs of support before you buy. Relative Strength 30 and Heavy Buying will be excellent Option Stalker searches out of the gate this morning. Also use the After Earnings searches.

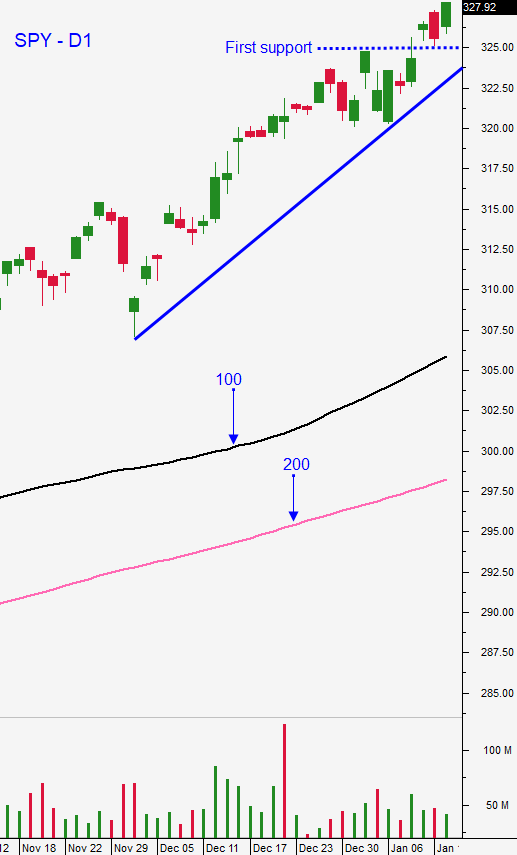

This is a light news cycle and that favors the upward momentum. Wait for support this morning and look for opportunities to buy stocks with relative strength. Fist significant support is SPY $327.50

.

.

Daily Bulletin Continues...