A Sluggish Economic Recovery Is Weighing On the Market – Use This Option Strategy To Generate Income

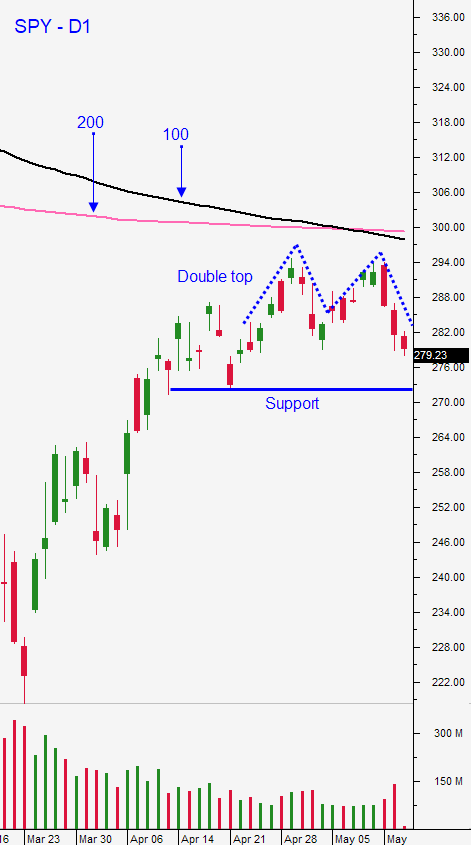

Posted 9:30 AM ET - The market tried to get through resistance at SPY $294 this week and that rejection formed a double top. The virus is resurfacing after countries have reopened and that has sparked selling on the notion that the recovery will take longer than expected. Support at SPY $288 has been breached and SPY $280 will be tested today.

The Fed does not plan to push interest rates into negative territory and Republicans are not likely to pass an additional $3 trillion stimulus plan. Piles of money have been thrown at the problem and they want to gauge the recovery before they take additional action.

Companies will use the PPP stimulus to rehire workers, but employees will be looking over their shoulder. If the workload is light, they will assume that they will get laid off after the stimulus runs out. Consequently, consumers will be very cautious with their spending and that will impede the economic recovery.

There isn't any clarity. Economic data points are backwards looking and data collection has been difficult. Earnings releases did not include much of the shutdown and most companies are not providing guidance. The speed of the reopening is unknown and we don't know how badly consumer confidence has been damaged. All of these factors need to play out.

Asset Managers are erroring on the side of being long. Fixed income yields are not keeping pace with inflation (negative real returns) so they feel compelled to have some equity risk exposure. The market bid will be weakened because corporations are preserving cash and they have suspended stock buyback programs.

From my perspective, we are in wait and see mode.

We have very little overnight risk exposure currently. In the Weekly Swing Trading Video I highlighted two bullets put spreads and to bear his call spreads last night. In this market environment we need to roll up our sleeves and conduct fundamental analysis. Our trades are reviewed on a case-by-case basis and we are focusing on relative strength and relative weakness. By selling out of the money option premium we are distancing ourselves from the action and we are taking advantage of time decay. We need to bide our time and safely generate some income while we wait for clarity.

Day traders should wait for support this morning. The early market decline will make it easy for us to find relative strength and I will buy these stocks when support is established. I plan to set passive targets and I will take profits quickly. After this first round of trades I will evaluate market strength. I don't know if we will see persistent selling or if buyers will surface. Use the 1OP indicator as your guide. When we get big spikes in the indicator we need to take profits on long positions and we need to consider shorting stocks with relative weakness. When the indicator forms a deep trough it is time to take profits on our shorts and to buy stocks with relative strength. Trading these reversals in the first half of the day has been very profitable for us. I am reducing my trade size and trade count in the afternoon session.

Support is at SPY $280 and $272. Resistance is at $287 and $294. The low end of the trading range for the last two months is $272 and a breach would lead to further selling.

.

.

Daily Bulletin Continues...