Market Is Directionless – Trading Range Is Intact – Use This Options Trading Strategy

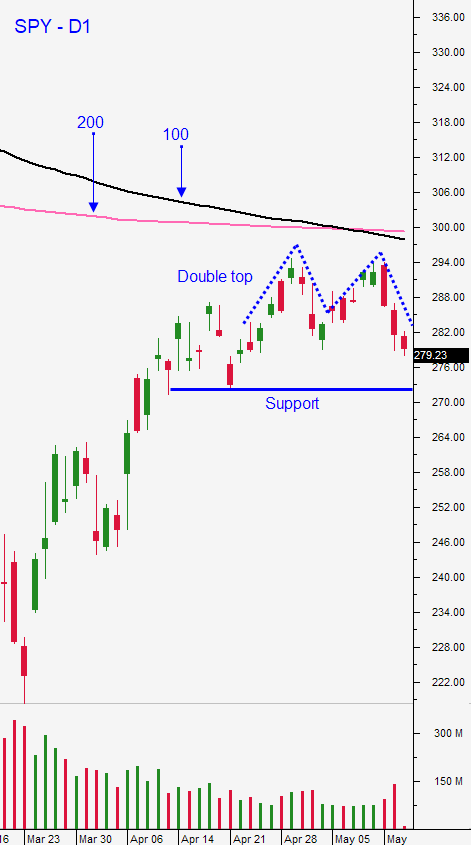

Posted 9:30 AM ET - Two days ago the market opened at a new relative high and it sold off the entire day leaving a bearish engulfing pattern on the daily chart of the S&P 500. Yesterday, the market dropped and it found support just above a horizontal support level. Buyers stepped in and we closed near the high of the day leaving a bullish hammer on the daily chart. The price action this week tells us that there is a great deal of uncertainty and that the market could move in either direction. Time is the missing ingredient and it will give us clarity. I believe that the S&P 500 will stay in the current trading range for a few more weeks while Asset Managers monitor the pace of the global economic recovery.

China's industrial output was stronger than expected (3.9%) and retail sales declined 7.5% (worse than expected). In the US, April retail sales declined 16.4% and Empire State Manufacturing was -48.5. The economic data points are backwards looking and in my opinion they are unreliable. We all know that conditions are horrible and we can expect dismal numbers in the future. I believe that the speed of the recovery and appetite for consumer spending in the next few weeks will determine market direction.

The United States is trying to reopen and politicians are facing pressure from both sides. The Coronavirus has proven to be very resilient and new cases in Wuhan, South Korea and Germany are popping up. The daily death toll in the United States is still above 1500. Healthcare officials are warning that a premature reopening could lead to another outbreak. On the flipside, businesses are on the brink of failure and families are running out of money. Workers want to get back on the job and they are protesting. Battles between the two groups are breaking out.

Some healthcare officials believe that we are close to a vaccine or an effective treatment and that it might be available this year. Other healthcare officials believe that we are in for the worst flu season ever.

I've been mentioning in my market comments that Asset Managers are erroring on the side of being long. Global interest rates are at historic lows and yields don't keep pace with inflation (negative real returns). This condition is forcing investors to buy equities. Central banks are printing money like mad and that is providing a safety net. As long as the threat of a credit crisis is minimal, the market will be able to tread water. If the reopening is sluggish and if consumers are tightfisted, credit issues could surface. We need to wait for clarity.

Swing traders are largely in cash. We've taken profits on all of our older positions and we currently have a balanced portfolio of bullish put spreads and bearish call spreads from this week's Swing Trading Video. We are going to look for opportunities on a stock-by-stock basis and we will focus on relative strength and relative weakness. A balanced portfolio of option spreads gives us a fairly neutral market bias and it allows us to generate income from time premium decay. Selling out of the money option spreads allows us to distance ourselves from the action. We will let the market move around and we will wait for clarity. I like being short premium into the Memorial Day holiday.

Day traders should find relative strength early this morning. It will be easy to spot since the gains from the last 30 minutes of trading yesterday will be stripped away (S&P 500 down 30 points before the open). I will initially be looking for stocks with relative strength and I will be playing a bounce. I will set passive targets and I will take profits. Once I'm in cash I will evaluate the price action and I will look for the next opportunity. We will use the early price action and the 1OP Indicator for market direction this morning. It's important to stay fluid in this market. Always have a wish list with longs and shorts. I still prefer to trade for the long side and I am finding more consistent price action there.

The economic numbers this morning were concerning, but not surprising. Support is at SPY $280 and $273. Resistance is at $282 and $285.

I consider this to be a fairly low probability trading environment. Keep your size small and wait for clarity.

.

.

Daily Bulletin Continues...