Market Will Test the Upper End of the Range This Morning – Resistance Has Been Stiff

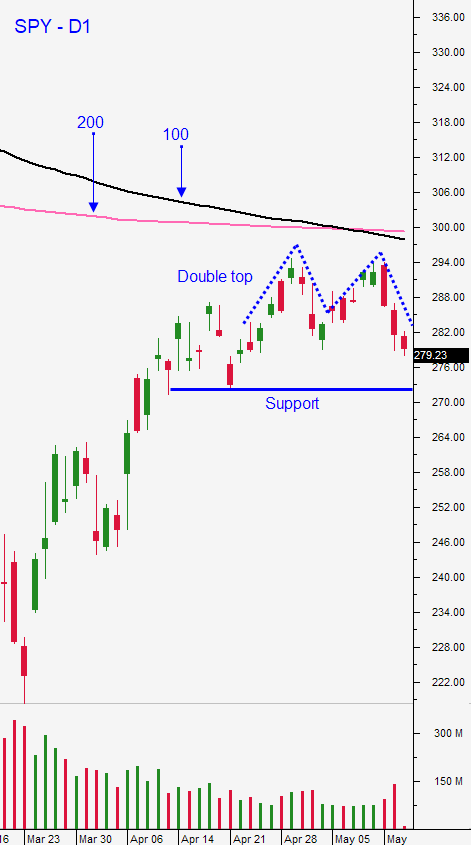

Posted 9:30 - PRE-OPEN MARKET COMMENTS MONDAY - The market is trapped in a trading range from SPY $272 to $295 and we will test resistance today. Asset Managers need clarity. The speed of the reopening and consumer spending will determine market direction. This will be a relatively choppy week and the volume will decrease ahead of a major holiday.

Last week the SPY challenged resistance at SPY $295 and we saw steady selling and a reversal off of that high. The downward momentum continued and we tested the low end of the range Wednesday. Stocks immediately reversed off of that low and that was a sign that buyers are still engaged.

Earnings season did not provided clarity. Most companies are not providing guidance because they don't know what to expect.

Economic data points have been horrific and I question the reliability. Businesses and data collection agencies have been closed so we don’t know if the numbers are accurate. Besides, most of these economic reports are backwards looking.

The entire world is trying to reopen and we are seeing new Coronavirus "hotspots". People are afraid that new cases will spike as stores and restaurants reopen. Temperature scans are being used extensively and social distancing procedures will continue.

Companies are scrambling to find a vaccine and there have been many positive reports. If a vaccine or an effective treatment is found, the production and distribution will still be a challenge. The fall flu season is right around the corner.

A year ago the market would have dropped on news that the US and China are in a trade spat. President Trump is pushing to bring manufacturing back to the US and tax incentives will be provided to companies who leave China. Huawei is still in the crosshairs and this could raise tensions between the two countries as new restrictions are being considered. The focus is on the Coronavirus and on the global recovery so this news item is being swept under the carpet.

Federal Reserve Chairman Jerome Powell said that the Fed still has lots of firepower in a 60 Minutes interview. The Fed will do everything in its power to avoid a credit crisis. The House approved a $3 trillion stimulus package last week and the Senate is likely to sit on it. They want to gauge the success of the stimulus that has already been provided and they want to monitor conditions as the economy reopens.

Everything to this point has been fairly predictable. We knew that virus related deaths would be high and that the curve would be flattened. The shutdown has lasted a little longer than expected and the reopening is dragging on. The next piece of the puzzle is critical. We don't know how quickly the economy will recover or how consumers will respond. In some industries there will be permanent damage.

Swing traders need to wait patiently. This is a stock pickers market and there are opportunities to sell bearish call spreads and to sell bullish put spreads. Our overnight risk exposure is fairly small and many of our positions expired worthless for a profit last week. We will distance ourselves from the action by selling out of the money bullish put spreads on stocks with relative strength and by selling out of the money bearish call spreads on stocks with relative weakness. The strategy will generate income while we wait for clarity and time decay will work in our favor. The price action should be fairly dull this week and option implied volatilities should contract. I am favoring the upside and my bias is slightly bullish.

Day traders need to watch for opportunities on both sides. This morning the S&P 500 will gap higher and this has been a difficult trading set up for us. The price action has been much more consistent on the long side and relative strength is more difficult to identify when the market gaps higher. Ideally, the bid will be tested and we will see a small pullback in the first hour of trading. This will reveal relative strength and our first round of trades will be on the long side. After that first window of opportunity we need to evaluate the price action to determine if we are in a range day for a trying day. Based on that analysis we will look for a second window of opportunity. I don't have a clear sense of direction because the market is in a range and we've tested both extremes in the last five days. I won't know how to position our trades until I see the price action and until I can see the 1OP indicator. I view this as a fairly low probability trading environment.

Look for choppy price action within the SPY $272 - $295 range and expect the volume to decrease towards the end of the week.

.

.

Daily Bulletin Continues...