Economic Recovery Better Than Expected – Take Profits Into Strength – Wait To Reload

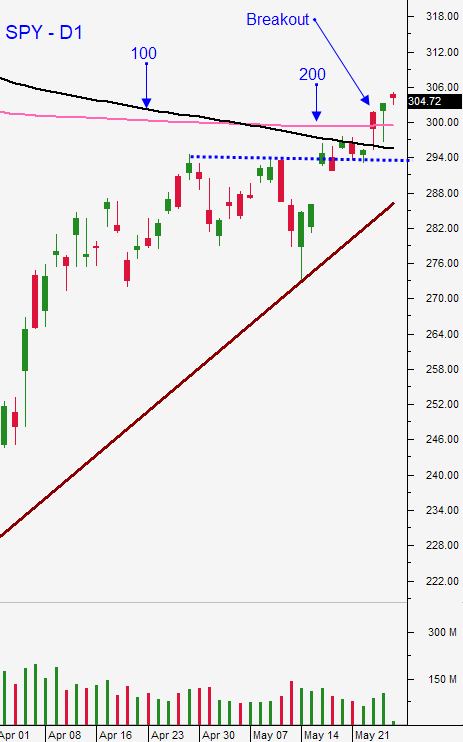

Posted 9:30 AM ET - Stocks took a breather yesterday, but they are back on track this morning. The S&P 500 is up 45 points before the open and it will rally to a new relative high. Global economies are reopening and there are signs that the recovery is brisk. Asset Managers are not waiting for signs of consumer confidence, they are buying now with the notion that monetary easing and fiscal stimulus will be used if needed. The volume is light and traders need to use caution.

This is been a big week for economic releases. ISM manufacturing and ISM services are both surveys and as such they tend to be forward-looking. Both numbers came in better than feared. ADP reported that 2.76 million jobs were lost in the private sector during the month of May and that was better than the 11.5 million job losses that were expected. This morning, the Unemployment Report was also better than feared and the unemployment rate came in at 13.3% (19.5% expected). Overall employment rose by 2.5 million when most analyst had forecasted a decline of more than 8 million.

China's economy reopened in April and it is the litmus test. This week its manufacturing and services PMIs were better than expected and both were in expansion territory (above 50).

New Coronavirus cases are decelerating on a percentage basis and the reopening has not caused a spike as many had feared. AstraZeneca (AZN) is producing 2 billion doses of a vaccine and it plans to distribute 400 million doses in the US starting in September. It's not known whether the vaccine will be safe or effective, but the company has enough confidence in the drug to take this risk. Scores of biotech firms are scrambling to develop a vaccine and there are positive developments each week as clinical trials ramp up.

Airlines are reporting a rapid increase in ticket sales and Las Vegas has hordes of gamblers in the street celebrating the reopening. People seem very anxious to get their lives back on track and pent-up demand should fuel the first leg of the recovery. Laggards (retail, restaurant, hotel, airlines and energy) are catching a bid and the bounces are brisk.

Swing traders need to continue selling out of the money bullish put spreads. This is a great way for us to distance ourselves from the action and to generate income. Our overall risk exposure is minimal and we will wait for a dip so that we can reload. The rally this week has come on light volume and great news is priced into the market. This global economic shutdown has devastated profits and the bottom line damage will take quarters to repair. Stocks need time to grow into their current valuations and that means that the market should go sideways for quite a while once it hits resistance. Our risk exposure was heavy during the last two months and we made fantastic money. The easy gains have been made and we are throttling back into this rally. Although the early signs are encouraging, we still need clarity and we don't know if long-term consumer confidence will be restored.

Day traders need to wait for the bid to be tested. Stocks will spike higher after the open and at a minimum we need a compression so that we can identify relative strength. I would avoid buying stocks with huge gaps higher until they prove that they can hold the opening price. Gaps up have been difficult today trade. Typically stocks compres after making huge gains and the trading range is fairly tight during the day. If we are going to see an opening gap reversal, it will come in the first 30 minutes (unlikely). The economic news this week has been very encouraging. Be patient and wait for your windows of opportunity. I believe that the market will open higher and very gradually float upward. The rest of the day will be spent in a compression and we should see a small pullback in the afternoon. That little dip will present a buying opportunity and the S&P 500 should be able to close strong. If this scenario plays out we will have an opportunity to do some option lottery trades into the close. We look for stocks with relative strength and strong momentum and we buy options for pennies just before they expire. The final surge today will push the calls in the money and these trades can produce big profits. Option premiums have been declining and the strategy is viable once again.

The rally today feels fantastic and the clouds have parted. I feel that the rally is overextended and that valuations are stretched. Don't chase, be patient and wait for that pullback so that you can load up at a better entry point.

.

.

Daily Bulletin Continues...