Quadruple Witching – Watch For Call Option Lottery Trades Today [Here’s What We Need]

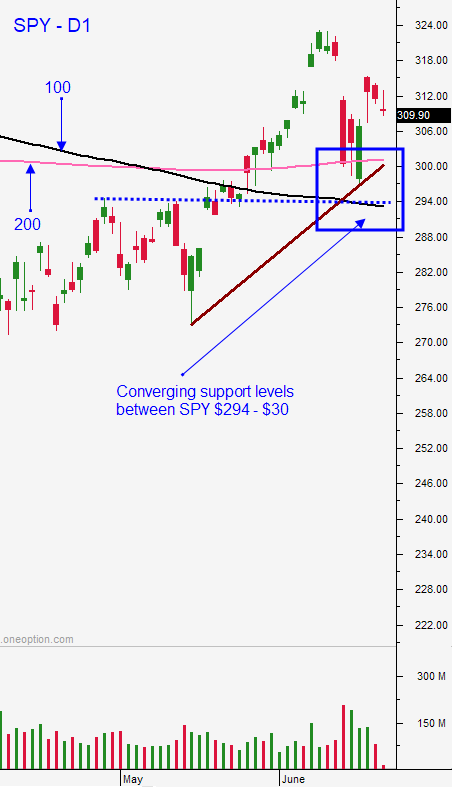

Posted 9:30 AM ET - This week the market has been able to rebound from a mini-correction that tested the 200-day moving average. Support at SPY $300 has been confirmed. Stocks will try to float higher and we could test SPY $322 in the next few weeks as Q2 earnings season approaches.

New Coronavirus cases are growing as the economic recovery unfolds. President Trump said that we will not shut the country down again. Social distancing and facemasks are needed to contain the spread of the virus. This new spike in cases is likely to slow down the recovery and it will impact consumer spending.

If the economic recovery is sluggish, we can expect monetary easing from the Fed and fiscal stimulus from the government. The Fed is buying corporate bonds and Congress is ready to approve additional stimulus that could reach $1 trillion. President Trump is also considering a $1 trillion infrastructure bill as well. The kitchen sink is being thrown at the economic recovery.

Asset Managers know that fixed income investments yield negative real returns because they don't keep pace with inflation. They will take their chances on the economic recovery and they are buying stocks. The Fed "safety net" has kept buyers engaged and major technical support at SPY $295 is firm.

Tech stocks have been leading the charge and many of them have benefited from the virus. They are not exposed to supply shortages and many of their employees can work remotely from home. We want to focus on this sector.

Swing traders should be selling out of the money bullish put spreads on strong stocks. In this week's Weekly Swing Trading Video I highlighted seven bullish put spreads. We have not been able to get filled on any of them yet and we need a small market pullback. We are not going to chase these stocks. Market conditions are still "nervous" and we can expect pullbacks. During the last three trading sessions we have seen late day selling and that is a small warning sign. If we don't get filled on our bullish put spreads, we will reevaluate and find new potential opportunities next week. I don't mind being in cash and if we do enter trades we need to excellent entry points. We are selling bullish put spreads that expire in three weeks or less and we are leaning on major technical support. The short strike price is below that technical support and that will increase our probability of success. Option implied volatilities are still elevated and an IV contraction will favor premium selling strategies. We also want to take advantage of accelerated time premium decay and that is why we are staying relatively short-term with these trades. Today our remaining bullish put spreads will expire worthless (maximum profit) and we will be 100% in cash.

Day traders need to watch the opening gap higher today. We are going to challenge the high of the week and that resistance might hold. Find stocks with relative strength and wait for the market bid to be tested. This is quadruple witching and conditions could be choppy today. I am favoring the long side and I am favoring stocks that are breaking through horizontal resistance. Relative strength and long green bars closing on their high in the first half hour of trading get my attention. Heavy Buying, Relative Strength 30 and Bull Run are my favorite searches.

We are in the summer doldrums and the news cycle is light. We don't have any economic releases for earnings to lean on. The market is starting to settle into a trading range and volume will decline as a major holiday approaches in the next two weeks. We are back in a fairly low probability trading environment and you should error on the side of caution.

I believe that the market bid will be decent today and we could see a late day rally. I will be looking for option lottery trades in the last hour of trading where I can buy options for pennies and sell them for big gains. I will need a strong close above SPY $315.50 for this opportunity and we could get it.

.

.

Daily Bulletin Continues...