Market Support Is Strong – Use This Options Trading Strategy Today

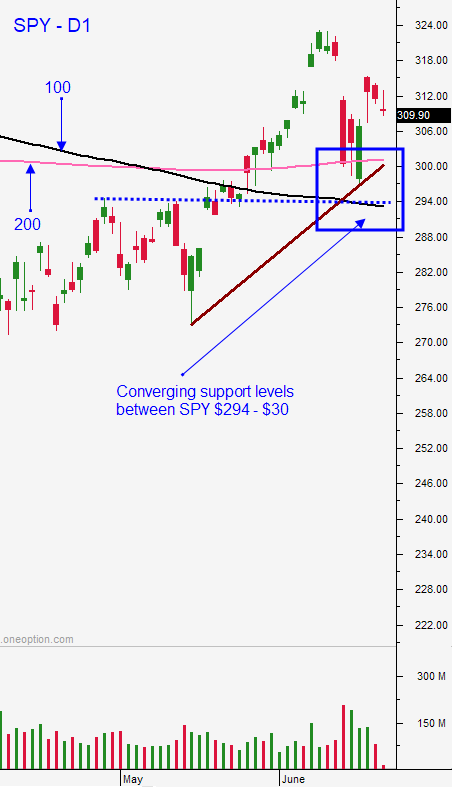

Posted 9:30 AM ET - The S&P 500 has tested the 200-day moving average three times in the last week and it has bounced off of that support level. Asset Managers have a "recovery or bust" mentality and they are relying on central bank money printing. Bond yields don't keep pace with inflation so those investments generate negative real returns. Stock valuations are stretched and the Coronavirus is resurfacing as the economy reopens, but that hasn't deterred investors. Look for price compression with a slightly upward bias the rest of the week.

Initial jobless claims were 1.5 million and that was worse than the 1.35 million that was expected. The economic releases are fairly light and we are heading into a "news vacuum".

Quadruple witching can produce wild swings as institutions "roll" their positions. We saw big moves Monday and Tuesday and the fireworks might be done for the week.

Earnings season is only a few weeks away and I believe the bid will strengthen as it draws closer. Tech giants have been fueling the rally and many (AMZN, FB, GOOG, MSFT and NFLX) have benefited from the shutdown. I believe that buyers will be engaged until all of the tech giants report. SPY $295 is a major support level and it will hold.

Swing traders should sell out of the money bullish put spreads on tech stocks. In last night's Weekly Swing Trading Video I highlighted seven new bullish put spreads. We are selling out of the money spreads that expire in 3 weeks or less and the short strike price is below technical support. We will need a market dip and a dip in the stock to get filled. We are not forcing trades, we are waiting for excellent entry points and there is a good chance that we might only get filled on a few of our spreads. This is a great income generating strategy and we will capitalize on implied volatility contraction and time premium decay. The key is to patiently wait for an excellent entry point and to pick the strongest stocks. Option Stalker searches help us find these candidates. I believe that major technical support for the S&P 500 will hold and that the market will compress during the summer doldrums. The SPY is likely to test $322.50 this month, but even without that market move our trading strategy will work. Let's see if we can get filled on our spreads. I like to stay inside of a three week window so that I can reevaluate market conditions and so that I can maximize time decay. If we are not filled on our spreads, we will wait patiently for the next opportunity.

Day traders should wait for market support this morning. Down opens have been our best trading environment and support is at SPY $309 and $307.50. The price action the last two days has been a little soft so don't rush the gun. Searches like Heavy Buying, Relative Strength 30 and Bull Run will provide the best candidates. As the market is ticking down, look for stocks that are grinding higher. Once market support has been established, buy these stocks and set passive targets. Ideally, the market will find support as the 1OP indicator is forming a deep trough on a five minute basis. That bullish cross will tell us when it's time to buy. Focus on tech stocks. After the first two hours of trading you can evaluate the price action. If we are trapped in the first hour range, trim your size and your trade count. This would be a sign that the price action will be dull. If the market is outside of that range you can increase your size. I won't be trading my normal size unless we can get above SPY $316 or below $307.

Last week the market rallied through the upper end of a trading channel and that typically sparks profit-taking. Bullish speculators were flushed out and we got a nice mini correction. That move provided us with a few days of action and I believe that things will settle down in the next few days. Unfortunately, we are headed for a low probability trading environment.

Try to sell some out of the money bullish put spreads on this market dip.

.

.

Daily Bulletin Continues...