Market Bid Is Strong – Use This Pre-Earnings Options Strategy Now

Posted 9:30 AM ET - Yesterday the market staged a nice rally and it closed above the 50-day moving average. Asset Managers are expecting a stimulus deal and the talks continue. This is a fairly light news cycle and we can expect a gradual grind higher.

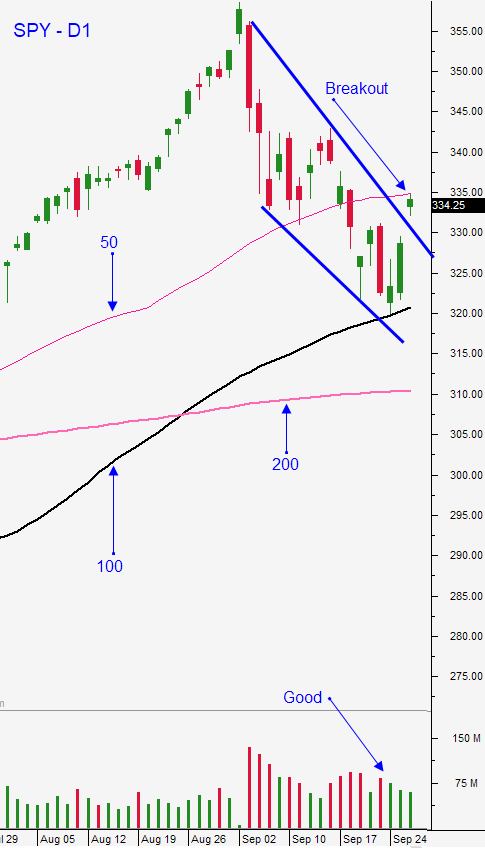

The S&P 500 found support at the 100-day moving average two weeks ago and it has broken through the downward sloping trend line that started in August. Earnings season is less than two weeks away and the bid is typically strong into those announcements.

President Trump is recovering from the Coronavirus. His health scare did not spark major selling on Friday, so I don’t believe his release from the hospital sparked buying yesterday. The rally Monday was related to the stimulus bill.

Economic conditions have been improving gradually. ISM services came in at 57.8 yesterday and that was better than expected. The calendar is light the remainder of the week.

Swing traders should gradually sell out of the money bullish put spreads on stocks with heavy volume and relative strength. I like selling premium below technical support levels. Option Stalker tracks historical price movement into earnings season and we are selling out of the money bullish put spreads on stocks that have rallied more than 75% of the time once they are inside of a two week window. This is a powerful statistical edge that dates back 3 years and we want to increase those odds by selling out of the money premium. This is currently one of my favorite strategies and we don't have to worry about the bottom dropping out of the market now that support has been established. Any market decline will be a buying opportunity.

Day traders should look for an upward bias. I have been finding better opportunities on the long side. China's markets have been closed for holiday and the volume during the day has been generally light. Now that the market is above the 50-day moving average we will lean on that support and we will use that level as our guide. Wait for support to be established this morning and trade from the long side.

Support is at SPY $336 and resistances at $342.

.

.

Daily Bulletin Continues...