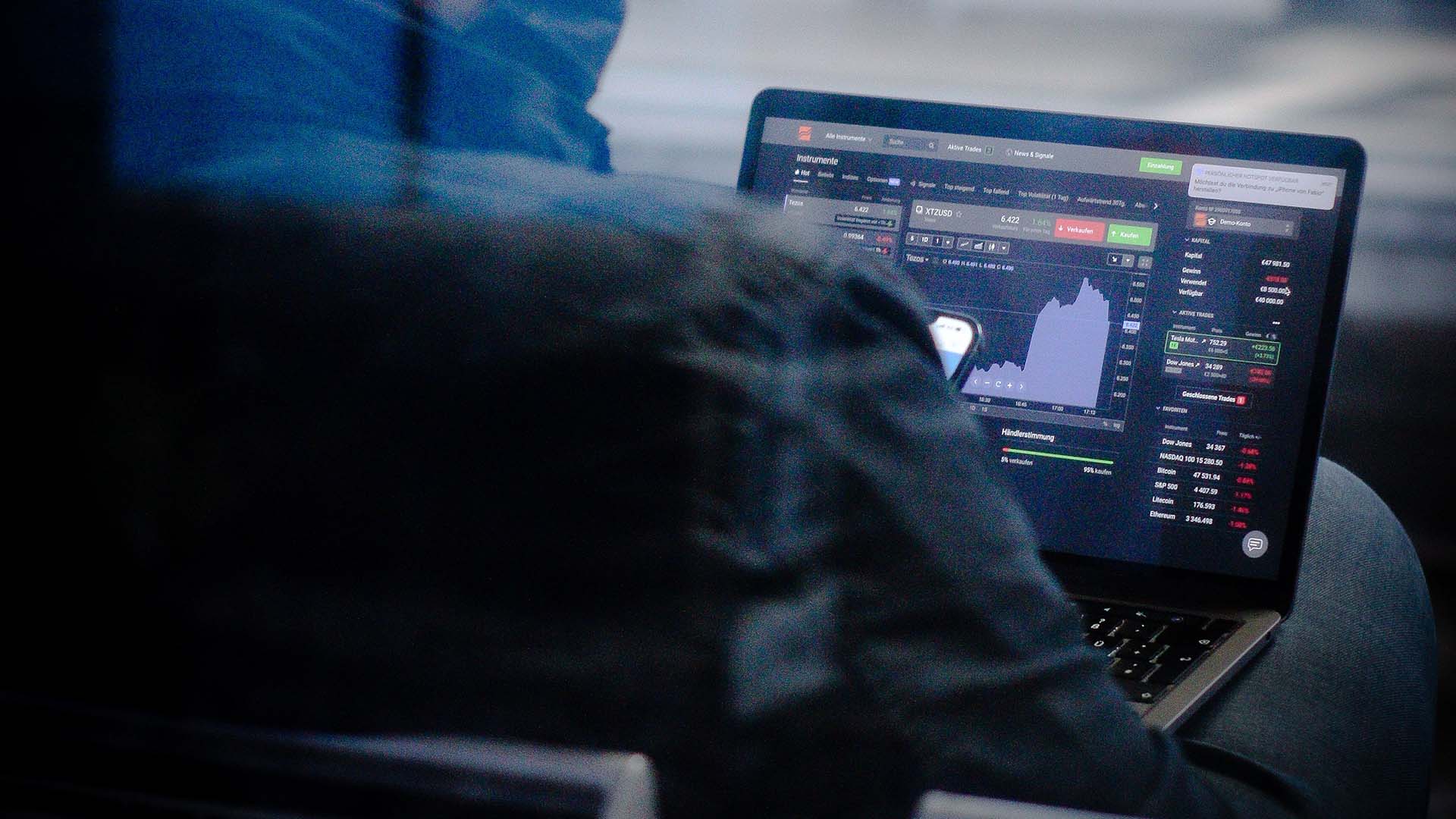

Option trading is one of the fastest growing areas in the financial industry. The option exchanges have consistently reported record option trading activity year-after-year. Speculators leverage stock positions by trading options while investors hedge risk through option trading. When you purchase a call option on a stock you have the right to buy shares at a specified price (the strike price) within a specified period of time (expiration date). When you purchase a put option, you have the right to sell shares at a specified price (the strike price) within a specified period of time (expiration date). The key concept is that you have the right, but not the obligation to take action. Some options expire worthless while others are exercised. However, the vast majority of option contracts are traded. As the price of the stock fluctuates, the bid/ask of the option changes. There is a pricing relationship between the stock and the option. Market Makers use sophisticated auto-quote systems to dynamically update the bid/ask. Serious option trading requires real-time quotes and split second executions. They are available through most online brokerage firms. Longer-term option trading can be attempted using delayed quotes. Options are a derivative of the underlying stock and the pricing concepts and strategies are complex. Before you attempt option trading, you should know option trading definitions. I divide them into 3 categories. Basic Option Trading Definitions – call, put, strike price, expiration date, exercise, assignment, contract, bid, ask, premium, intrinsic value, time decay. Strategic Option Trading Definitions – long, short, premium buying, spread, debit spread, credit spread, margin requirement, breakeven, diagonal spread, condor, back spread, butterfly, naked, covered call, strangle, straddle. Advanced Option Trading Definitions – implied volatility, delta, gamma, vega, theta, rho, Black-Scholes pricing model.

Option Trading Definition

Archives

July 21, 2012

2 min read