Question

This question was posted in September 2006, but the lesson still applies. Koonz asked, “I was looking at to buy a put on FLR after noting it had formed a Descending Triangle. It broke down and closed below the baseline at at $82 on September 8th with higher than average volume. I wasn’t sure when exactly to enter. Should I enter right away when market opens at 9:30 am EST or after 10:00 am EST because the first half hour is for amateurs? What signals do you look for when timing the exact entry for this type of trade?

Answer

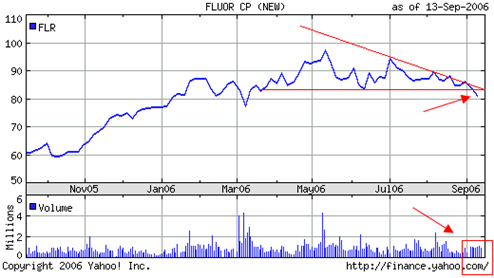

First let’s look at the stock. FLR has been in my Daily Report and I do think the short is worth a look. This construction company is involved in many project types and it services the oil industry. Fundamentally it trades at a rich P/E and construction in general is slowing. Let’s take a look at the charts.

A longer-term view confirms the formation. The red trend line shows the lower highs and the support level at $82 that is being tested with greater frequency. These patterns are very useful, but I urge you to draw your lines with a crayon as opposed to a pen. What I’m really saying is – use them as a general guideline. In this case, the descending triangle may not have been broken yet. What if I drew a shallow line exactly across the tops. Wouldn’t the longer-term descending triangle use a support base of $78? Perhaps. The point remains that the stock is rolling over and it is trading in the upper quartile of its 52-week range. The volume as shown by the red box has been increasing during the decline and that is also confirming weakness. Now let’s zoom-in.

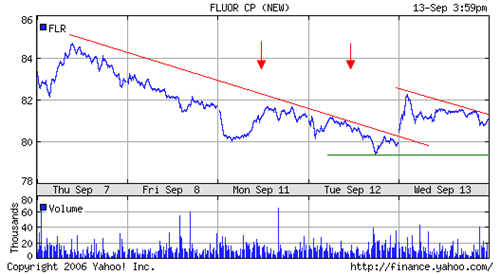

This is a 5-Day chart. The red trend line shows a nice tight downward move and it tells me that sellers are aggressive. Every time a buyer shows up to try and generate a bounce, their bid is immediately “hit”. The red arrows show you what the stock has done this week during some VERY bullish days in the market. In fact, yesterday the energy stocks got a relief rally. Look at what the stock did. It ran up and then it was so weak that towards the end of the day it started to slip.

The trade seems to be valid and it is time to consider entry. Remember my article about the market? Start with the market! We are currently making a new 4-month high and we have an expiration related rally. This means that you will be fighting the market and you might take some heat. I never assume that I’m going to get in at the best possible price so I try to scale in. It helps me control my emotions. If I just have a small position, I’m not worried if it moves against me and I can evaluate and add objectively. If I got the entry right and the stock tanks, I have a position that’s making money and I’m still happy. Never feel like technical confirmation translates into immediate action. It should merely put you on high alert and you should start to closely monitor the price action.

I try to determine my plans the night before based on the prior day’s closing movement. By the afternoon I’ve had the opportunity to observe price action and the institutions have “shown their hand”. You should avoid getting into positions on the open especially if there is a big move. Wait an hour and you will get a feel for the market, the sector and the stock. There is much more information to support your decision at that time. In the case of a short, I like to see a stock quietly take out the prior day’s low without the help of the overall market. Note: getting out of a trade on the open is a different issue. If you are in a big overnight winner/loser, it might be wise to take partial profits/losses in the first half hour.

In the case of FLR, I would short a little stock after the open. If the stock is able to stay below $82 and it continues to show relative weakness, I would add to the position. I trade relative strength and weakness. My signal to get in is continued relative weakness and this stock has it – for now. If the stock starts to deteriorate and it breaks below $80 and then $78 quickly, I would add aggressively and keep a hard stop around the $82 level.

If you are trading options, let your opinion on the direction, duration, magnitude of the move guide you. Also, consider your confidence in the trade, the liquidity of the options and the implied volatility (IV).