Table of Contents

The Basics of Small Cap Stocks

Small cap stocks are shares of companies with a market capitalization that is typically considered lower than large or mid-cap companies, generally ranging from $300 million to $2 billion. These stocks represent companies that are often at an early growth stage or specialized in niche markets. They are a crucial part of the stock market, providing diversity and opportunities for investors looking for growth potential in different sectors.

The small cap segment includes a wide range of companies, from start-ups to established businesses in smaller industries. These companies, while smaller in size, offer unique products or services and have the potential for significant expansion and market penetration. They are an essential consideration for investors seeking to diversify their portfolios and tap into new market trends, but can be risky for traders.

Understanding Small Cap Stocks

Small cap stocks are characterized by their potential for substantial growth, which can lead to higher returns for investors. However, this comes with a higher level of risk and volatility compared to more established large-cap stocks. These companies are often in the process of expanding their market presence and improving their profitability, which can result in rapid stock price changes.

Investors interested in small cap stocks need to conduct thorough research to understand the company’s business model, market potential, and the risks involved. While these stocks can offer significant rewards, they require a more hands-on approach in terms of monitoring and managing the investment due to their inherent instability and the lesser degree of market analysis available.

Small Cap Stock vs. Large Cap Stock

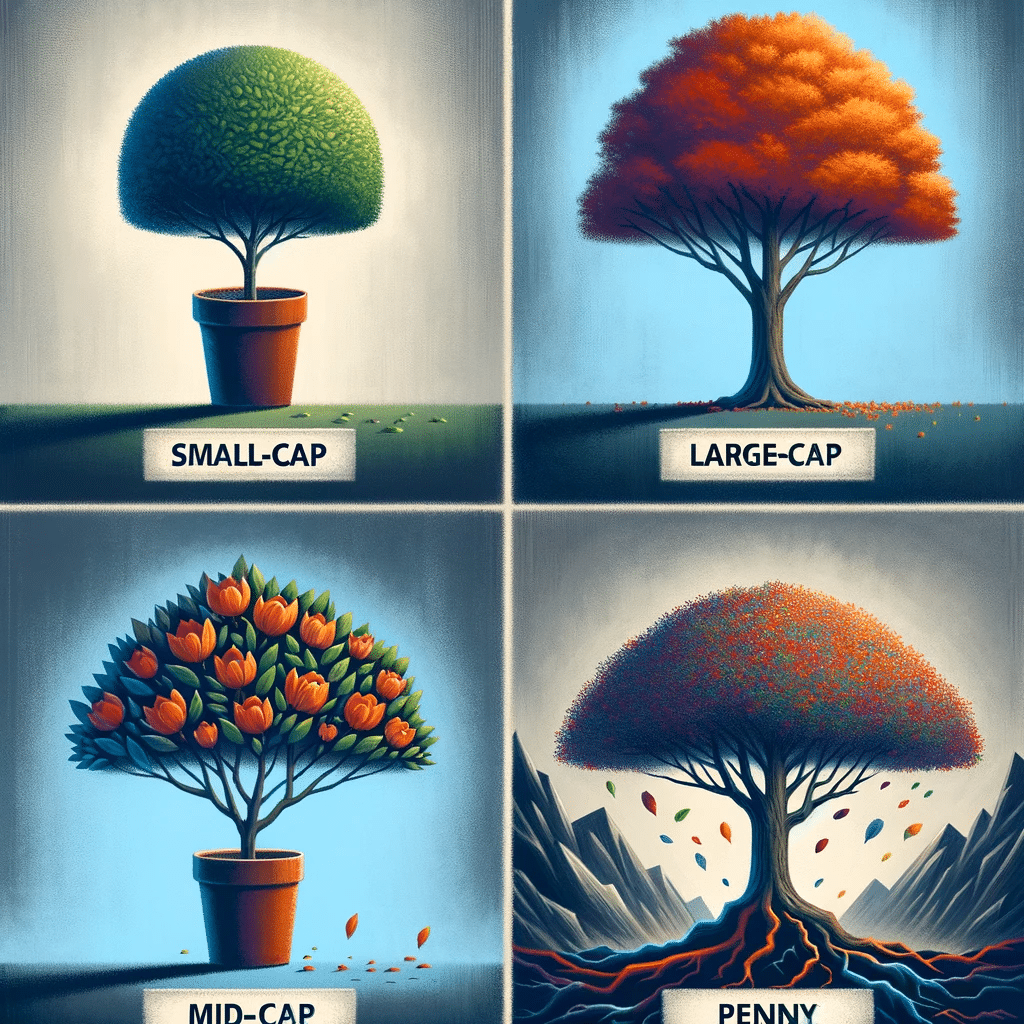

Small cap stocks represent smaller companies, which contrasts with large-cap stocks that belong to well-established, large companies with solid market presences, typically with a market capitalization of over $10 billion. Large-cap stocks are often industry leaders and offer stability and consistent dividends, making them a safer investment choice compared to small caps.

While large-cap stocks provide stability and are often less volatile, small cap stocks offer higher growth potential. This makes them more suitable for investors looking for aggressive growth and who are willing to tolerate higher market volatility. The key difference lies in the risk-reward trade-off between the potential for rapid growth in small caps and the stable, yet slower growth in large-caps.

Small Cap Stock vs. Mid-Cap Stock

Mid-cap stocks, with market capitalizations typically between $2 billion and $10 billion, offer a middle ground between the high growth potential of small caps and the stability of large-caps. They are often companies in the process of expanding their market presence and can provide a balance of growth and stability.

Small cap stocks, on the other hand, are generally more volatile and offer higher growth potential but with increased investment risk. They are suitable for investors who are willing to take on more risk for the possibility of higher returns. The choice between small cap and mid-cap stocks depends on the investor’s risk tolerance and investment goals.

Small Cap Stock vs. Penny Stock

Penny stocks are typically defined as stocks priced below $5 per share, often belonging to very small companies. They are considered highly speculative and risky, mainly because they are less regulated and often not listed on major exchanges, unlike small cap stocks. Penny stocks can offer high returns but are also prone to extreme price volatility and less transparency.

Small cap stocks, while also offering high growth potential, are generally considered more reputable than penny stocks. They are listed on major stock exchanges and must meet specific regulatory requirements, providing more security and transparency for investors. The choice between small cap stocks and penny stocks depends largely on the investor’s risk appetite and investment strategy.

Interested In Learning More?

Advantages and Disadvantages of Small-Cap Stocks

Advantages of Small-Cap Stocks

Small-cap stocks offer significant growth potential. They often represent emerging companies with innovative products or services, allowing investors to capitalize on new market trends. These stocks can outperform larger companies in terms of percentage growth, especially in bullish market conditions.

Another advantage of small-cap stocks is the opportunity for value investing. These stocks are sometimes undervalued in the market, providing savvy investors with the chance to invest in promising companies at a lower price before they become well-recognized in the market.

Disadvantages of Small-Cap Stocks

The primary disadvantage of small-cap stocks is their high volatility. They are more susceptible to market fluctuations, making them a riskier investment choice. This can lead to significant price swings, which can be challenging for investors with a low risk tolerance.

Additionally, small-cap companies often have limited resources compared to larger companies. This can make them more vulnerable to economic downturns and market challenges, potentially impacting their growth and stability.

How to Day Trade and Swing Trade Small-Cap Stocks

Day trading and swing trading in small-cap stocks require a proactive approach, leveraging their high volatility for potential short-term gains. It involves closely monitoring market trends and company news to make quick, strategic decisions.

However, this type of trading demands a thorough understanding of market dynamics and the ability to manage risks effectively. Investors must be prepared for the rapid changes in stock prices and have a clear exit strategy to minimize losses.

Trading Momentum Stocks with Small-Cap Stocks

Momentum trading involves capitalizing on stock trends, and small-cap stocks are often ideal for this strategy due to their high volatility and potential for rapid growth. These stocks can experience significant price movements, driven by market sentiment, news, or company-specific events, making them prime candidates for momentum traders. Small-caps offer the agility and rapid price changes that can yield significant profits within short time frames, appealing to traders who are adept at identifying and riding market trends.

However, the volatility that makes small-cap stocks attractive for momentum trading also brings inherent risks. Price swings can be abrupt and unpredictable, requiring traders to have robust risk management strategies. The challenge lies in accurately timing the market, a skill that often comes with experience and thorough market analysis.

Disadvantages of Trading Momentum Stocks and Recommendations for Beginners

Trading momentum stocks, especially small-caps, can be challenging for beginners due to the high risk and need for quick decision-making. These stocks require constant market monitoring and a deep understanding of market indicators, which can be overwhelming for new traders. The rapid price movements and potential for significant losses make it a high-stakes trading strategy.

For beginners, trading larger, more established stocks is often recommended. Large-cap stocks typically offer more stability, less volatility, and are backed by more comprehensive market data and analysis. This environment allows new traders to learn and understand market dynamics without the intense pressure and risk associated with momentum trading in small-cap stocks. Starting with large-cap stocks provides a foundation for building trading skills and knowledge, which can later be applied to more complex strategies like momentum trading.

ETFs and Tracking Small-Cap Stocks

Exchange-Traded Funds (ETFs) are investment funds that are traded on stock exchanges, much like individual stocks. They offer a way to invest in a broad portfolio of assets, including stocks, bonds, or commodities. ETFs are known for their low expense ratios and tax efficiency. For small-cap stocks, ETFs can be a valuable tool for investors looking to gain exposure to this segment of the market without the risk of investing in individual companies.

Using small-cap ETFs, investors can track the performance of a basket of small-cap stocks, providing insights into the overall trends and health of the small-cap market. This approach allows for diversification, reducing the risk associated with investing in single small-cap stocks, while still capitalizing on the growth potential of this market segment. ETFs offer a more manageable and less risky way to engage with small-cap stocks, making them suitable for a wide range of investors, from beginners to experienced market participants.

Small-Cap Stock Indexes

The Russell 2000

The Russell 2000 Index is a significant small-cap stock index in the United States. It represents approximately 2,000 small-cap companies, offering a comprehensive overview of the small-cap sector of the U.S. equity market.

This index is widely used by investors as a benchmark for small-cap performance. Its diversity across various sectors provides a clear picture of the overall health and trends within the small-cap market.

The S&P 600

The S&P SmallCap 600 Index is another key index, encompassing 600 small-cap companies in the U.S. It is known for its strict eligibility criteria, including profitability, which helps ensure a higher quality of included companies.

This focus on profitability differentiates the S&P 600 from other small-cap indexes, potentially offering better risk-adjusted returns. The index is a valuable tool for investors looking to gauge the performance of small-cap stocks with a focus on financial health.

Conclusion

In conclusion, small-cap stocks offer a dynamic and potentially rewarding investment opportunity, particularly for those willing to navigate their inherent volatility and risk. They stand out as a distinct segment in the equity market, characterized by their potential for rapid growth and ability to respond swiftly to market changes. For investors, these stocks present an opportunity to diversify portfolios and capitalize on emerging companies and industries.

However, investing in small-cap stocks requires thorough research, a keen understanding of market dynamics, and a tolerance for risk. The balance between the potential for high returns and the risk of significant fluctuations necessitates a strategic approach, making these stocks more suitable for informed and experienced investors. Ultimately, small-cap stocks hold the promise of significant rewards but demand careful consideration and prudent investment strategies.