Purpose:

The Ultimate Oscillator is a momentum indicator that compares prices using three different periods, offering a more comprehensive view of price momentum than single-period oscillators. It helps traders identify potential trend reversals and divergences by analyzing the combined results of these three oscillators.

Key Components:

- Three Periods of Analysis:

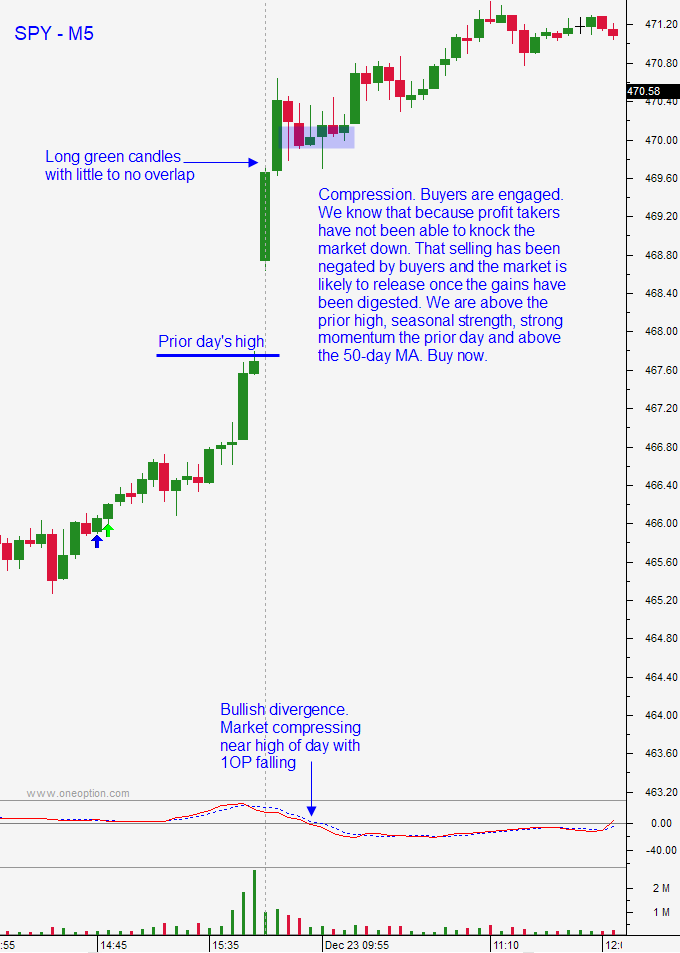

The Ultimate Oscillator uses three different time periods (short, medium, and long) to calculate its value. This multi-timeframe approach helps smooth out price fluctuations and provides a more balanced view of momentum. - Price/Indicator Divergence:

A popular way to interpret the Ultimate Oscillator is by looking for divergences between the price and the indicator. A bullish divergence occurs when the price makes a lower low, but the indicator makes a higher low, suggesting a potential reversal to the upside. Conversely, a bearish divergence occurs when the price makes a higher high, but the indicator makes a lower high, indicating a potential downside reversal. - Buy and Sell Signals:

Traders often use the Ultimate Oscillator to generate buy and sell signals based on divergences and the crossing of key levels (e.g., 70 for overbought and 30 for oversold). These signals can help traders time their entries and exits more effectively.

Summary:

The Ultimate Oscillator is a versatile momentum indicator that compares prices across three different periods. By analyzing divergences between the price and the indicator, traders can identify potential trend reversals and make more informed trading decisions.