Stock Option Trading Strategy: Close Bearish Call Spreads and Sell Bullish Put Spreads

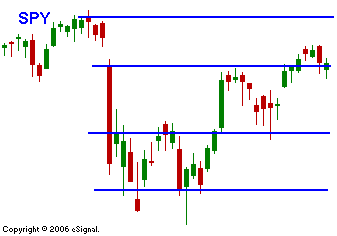

Tuesday the market marched right up to the high made after the FOMC meeting and it did not back off. Yesterday, the bears were not able to put a dent into the gains and I get the feeling we are in “go-go” mode again. This means the unemployment number will be “spun” in a positive way. If unemployment rises, the bulls will claim that Fed easing is around the corner. Conversely, if employment is strong the bulls will rationalize that disposable income is good for the economy. “Merger Mondays” have provided a positive start to the week and I feel that the impact of a negative employment number might be mitigated by another take-over announcement. If Friday’s number is bullish we might see a retest of SPY 146 next week. In order for the number to create a sell off, we will need to see and unexpected rise in unemployment and a "hot" hourly wage component. That will create concerns that the Fed has waited too long to ease and that they may stay with the existing "tight light" bias due to inflation. Today will be very quiet and the range has been very tight. I have reeled in most of my bearish call spreads since the market has been able to breakout and hold. I will look to add bullish put spreads next week if the market adds to its gains from this week. Have a great holiday.

Daily Bulletin Continues...