Stock Option Trading Strategy: Close bearish call spreads and consider new bullish put spreads.

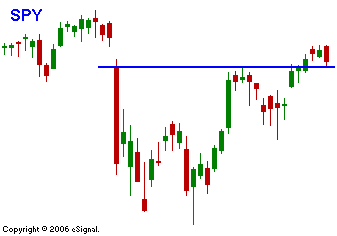

Yesterday the market marched right up to the high made after the FOMC meeting and it did not back off. Today, it would be typical for the bears to try and slap the market down on the open. The bulls will stand back and see just how much of the gains the bears can take back. If the bears are successful and they can do some damage, the bulls will step aside. If the bears are not able to generate anything, the bulls will start nibbling. No one wants to buy a top and after a 14 point S&P 500 rally and the bulls want to make sure there is a chance for follow through. A weaker ISM and solid employment projections from the ADP report could not dampen spirits. The bears were hardly able to put a dent into yesterday’s gains. The British soldiers were released, oil prices are lower and global markets were up big overnight. It used to be that the US markets would set the tone – that is not the case now. Many foreign markets are making new highs and we are lagging. The table is set for a rally and this is a significant resistance level. If it grinds higher there might be a short covering pop or two along the way. My stock option trading strategy today is to buy in my bearish call spreads. I am looking to add out-of-the-money bullish put spreads on stocks that have held up well. I don’t want to get long, I am neutral. I respect the rally and I’m distancing myself from the action by favoring bullish put spreads. We still need to get through the Unemployment Report Friday. I get the feeling we are in “go-go” mode again and the number can be “spun” in a positive way. If unemployment rises, the bulls will expect Fed easing and that will be viewed as bullish. If the employment is strong, the bulls will take the intuitive route and rationalize that disposable income is good thing. For today, I am expecting a grind higher and a close above SPY 144. In the chart you can see that tech stocks are challenging resistance. Notice the violent snap back rallies that follow a decline. I suggest closing bearish call spreads on tech stocks that have been “hot” lately.

Daily Bulletin Continues...