Option Trading Strategy: Out of the money put credit spreads – out of the money call credit spreads

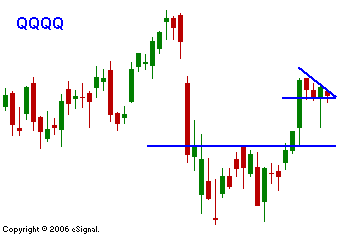

Yesterday if looked as if the market might sell off as a result of weak housing data. As the day wore on, the bears were unable to push prices lower and the bulls confidently stepped in to try their hand. By the close, the market was in positive territory. This morning we have the same scenario setting up. Weak consumer confidence and dismal results and guidance from homebuilder LEN weighed on the market. If the bears can’t sustain a sell off, the bulls will take charge once again. There is a slightly better chance that the bears will win today. Bullish speculators are expecting the rally and they may get long prematurely. Asian markets were down and the A/D is a negative 1:3 two hours after the open. In the chart you can also see that tech stocks are struggling to hold on to the gains from last Wednesday. I believe that the market will retest the SPY 141 level in the next week or two. Retirement account funding ahead of tax season will lend support to the market for a few weeks as that money gets placed. My option trading strategy is to sell put credit spreads on the energy and basic materials stocks. The other side of option trading strategy is to sell call credit spreads on restaurants, newspapers and a few cyclical stocks. I believe the SPY 141 – 146 range may be in effect for a few weeks and I want to take advantage of time premium decay. If the range is breached, I will remove those trades and take on the respective market bias.

Daily Bulletin Continues...