Stock Option Trading Strategy – Long energy stock call options.

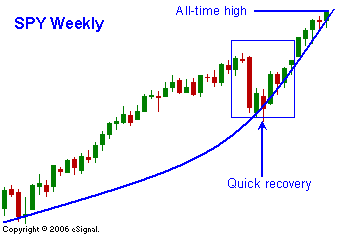

This morning the market opened higher in spite of overnight weakness in the Asia. No doubt this "pop" was option expiration related. One of the largest index options (SPX) expired on the opening. Even a small buy imbalance can have a material impact on where it settles. Energy stocks are the hottest sector around. Unrest in Nigeria is driving oil prices higher. Currently that country is our third largest source of oil. The market is oblivious to higher commodity costs and the inflation indicators seem to be keeping a lid on those concerns. M&A continues to keep a strong bid in this market. The shorts are running scared and it has been almost impossible to make money on bearish trades. In the chart you can see that the SPY is close to an all-time high. The market has a parabolic feel to it and it has rallied 22% in less than a year. In the chart you can see that the market recovered very quickly from the February decline. This is a sign that the market currently has a full head of steam. This type of setup can lead to a "melt up" and a sharp decline. If that happens there will be plenty of money to be made on the upside, but you'd better be quick to pull the trigger once the peak is established. For now, I like energy stocks and I believe the macro conditions are in place for these companies to make large profits. I will still look to establish bull put spreads next week.

Daily Bulletin Continues...