Stock Option Trading Strategy – Bull put spreads and long energy stock call options.

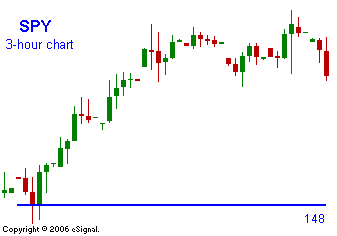

Yesterday the FOMC comments were unchanged. Surprisingly, the market had a positive reaction. After sleeping on it, it looks like the negative reaction might be taking place this morning. In overseas news, England raised interest rates a quarter point. This puts upward pressure on other interest rates, including ours. When you combine a higher interest rate with a stable British Pound you have a fixed income product that is more attractive than US Treasuries. As investors sell our treasuries in favor of other foreign debt, our treasuries go down in price and the implied yield goes up. Perhaps the biggest factor this morning is the dismal performance in the retail sector. Over 80% of the retailers came in worse than expected. Including this report, retailers have missed estimates two out of the last three times. The market is due for a pullback. The first level of support is SPY 148. The second level of support represents the breakout at SPY 146. The SPY is close to making an all time high and I believe we need a pullback to determine the strength of the market’s "bid". Earnings season has ended and the Fed is in a stalemate. I don't see a catalyst for this market and choppy, directionless trading is bound to set in. This is a good time to take profits on long positions. As long as the SPY maintains the 146 breakout level I will stay with my current option strategy: bull put spreads and long call options on energy stocks. Today, I believe the bulls will step aside. The headwinds are too strong and prices are likely to drift lower.

Daily Bulletin Continues...