Stock Option Trading Strategy – Bull put spreads and long calls on energy stocks

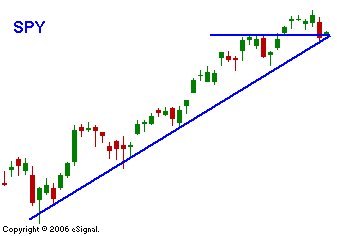

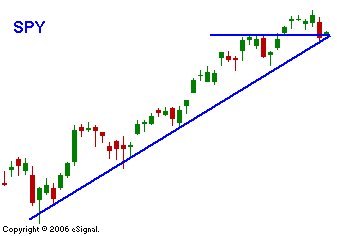

The market is seeking a catalyst. 10 days ago the S&P 500 was at this very level. In that time we have seen a decent round of earnings and they have exceeded expectations. With most of the numbers "in" the earnings growth rate is over 6%. That should be enough to sustain the uptrend. As I mentioned, I expected choppy trading this week and a negative reaction to the Fed’s unchanged rhetoric. The market also took issue with the weak retail sales numbers. Today, we got a bit of inflation relief from the PPI. In the grand scheme of things, the market is just chopping around looking for a piece of news that it can sink its teeth into. Next week the market might benefit from bullish option expiration activity. Per normal there is a chance that we will wake up Monday morning and read about a new merger. That will kick the week off and given the recent rally; the path of least resistance is up. This is a time to be cautious. The market is "sleepwalking" its way higher. Yesterday we saw the dramatic affect that one negative piece of information can have on prices. It will take two or three consecutive at pieces of information to topple this market. Let a series of lower closes and a technical breakdown be your guide. In today's chart you can see that minor support held today. The uptrend from March is also still intact. Long term, I still like the energy sector and I feel comfortable being long call options on oil stocks. I also like selling bull put spreads on stocks that have shown strength and raised guidance. This strategy allows me to keep a safe distance from the day to day "noise". The market is likely to grind its way higher throughout the day.

Daily Bulletin Continues...