Stock Option Trading Strategy – Bull put spreads, long call options on energy stocks.

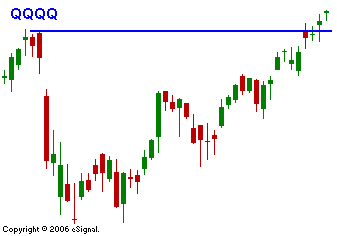

The market has been in a steady, but choppy trend higher. The tech stocks are finally participating in the rally and they have broken out. The latest round of earnings was positive for the most part, and the market is reacting. The financial stocks have led previous rallies that they have stalled. Now, money is rotating into cyclical stocks and tech stocks. That's a healthy sign and today we have a positive 2:1 advance/decline line. Now that we have a decent sampling from the earnings season, it is apparent that the earnings growth rate projections were low-balled. I would still like to see this market hold the SPY 146 level for a few weeks before I turn bullish. However, I suspect that like many other traders, I am getting a bit anxious and I don't want to miss did a breakout rally. Now that most of the major indices have confirmed the breakout, I believe the market will grind higher. I have added some bull puts spreads to my positions and I have also purchased calls on a handful of energy stocks. They held up well during the February decline and the global growth picture bodes well for higher energy prices this year. For today, I believe the market will add to the gains.

Daily Bulletin Continues...