Option Trading Strategy – Bull Put Spreads

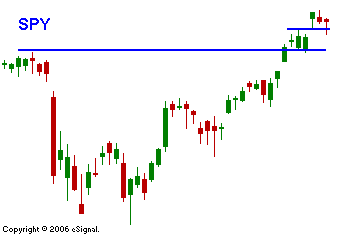

The market pulled back a bit yesterday and I attribute that to the big expiration rally last Friday. This morning we started off with good earnings and so far, companies have been posting earnings growth in the 6% range when 3% was expected. The early reaction seemed positive but that quickly changed with the release of housing data and consumer confidence. The market tested the downside on those two releases. On the housing front, we are continuing to see weakness. However, that is nothing new. Global growth is carrying our economy and that is off-setting the weakness in residential real estate. The market has recovered and it looks like it will try the upside. I still want to see the SPY hold the rally well into May. The cyclical stocks are on a rampage and in particular. Heavy equipment manufacturers with international sales are posting big numbers (CAT, PCAR, DE). I continue to sell bull put spreads. I expect the market to grind higher today and I still believe that earnings (not economic releases) will have the greatest impact on the market’s price action.

Daily Bulletin Continues...