Stock Option Trading Strategy – Watch the Fed and buy commodity stocks on dips.

Today the market is reacting to very strong overseas rallies. Most of the Asian markets were up over 2% in overnight trading. That backdrop provided a solid bid to our markets this morning.

The PCE price index came in under the Fed’s comfort zone which gives them the latitude to ease interest rates if needed. From the summit being held out west, Chairman Bernanke stated that the Fed is carefully monitoring economic conditions and they are prepared to step in if needed. With inflation being held in check, the bias is leaning towards an ease. This morning President Bush came to the rescue when he announced his aid package for low income families that are in jeopardy of losing their homes.

The Fed in comparison wields a much larger sword. The President's plan will aid approximately 50,000 families. On the other hand, the Fed’s actions will have a much greater impact on the overall economy.

I still believe that the Fed should maintain its current policy. If it does, I feel the market will rally after an initial decline. The signal being sent would be one of strength. First of all, the Fed will make it known that it is not going to cave in to pressure from the financial community every time a sector of the market gets a sniffle. Housing only accounts for 5% of GDP and the other 95% is strong. Second of all, the Fed will be making a statement about economic growth. By not lowering interest rates, they will signal that the current conditions are robust enough to stave off a recession.

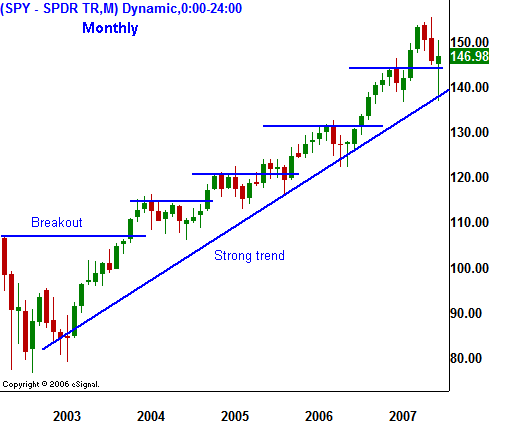

If you look at the monthly chart, you can see the strength of the market. The recent volatility barely registers a blip. I for one do not want to fade this trend and my instincts tell me that we are setting up for a great buying opportunity.

.

.

If the Fed does lower interest rates, the market will jump higher. That initial euphoria will quickly wear off when traders rationalize that trouble must lie ahead. The only way the Fed will lower rates is if they see deteriorating economic conditions. They have better data than any of us and I will use their actions as an indicator.

Next week’s Unemployment Report is an intermediate data point that will be scrutinized as analysts try to gauge the impact of housing. This is a time to keep your powder dry. I have been buying commodity stocks on dips and taking profits. That has been working out well. Also consider selling OTM put spreads on these stocks.

Have a great holiday!

.

If the Fed does lower interest rates, the market will jump higher. That initial euphoria will quickly wear off when traders rationalize that trouble must lie ahead. The only way the Fed will lower rates is if they see deteriorating economic conditions. They have better data than any of us and I will use their actions as an indicator.

Next week’s Unemployment Report is an intermediate data point that will be scrutinized as analysts try to gauge the impact of housing. This is a time to keep your powder dry. I have been buying commodity stocks on dips and taking profits. That has been working out well. Also consider selling OTM put spreads on these stocks.

Have a great holiday!

.

If the Fed does lower interest rates, the market will jump higher. That initial euphoria will quickly wear off when traders rationalize that trouble must lie ahead. The only way the Fed will lower rates is if they see deteriorating economic conditions. They have better data than any of us and I will use their actions as an indicator.

Next week’s Unemployment Report is an intermediate data point that will be scrutinized as analysts try to gauge the impact of housing. This is a time to keep your powder dry. I have been buying commodity stocks on dips and taking profits. That has been working out well. Also consider selling OTM put spreads on these stocks.

Have a great holiday!

.

If the Fed does lower interest rates, the market will jump higher. That initial euphoria will quickly wear off when traders rationalize that trouble must lie ahead. The only way the Fed will lower rates is if they see deteriorating economic conditions. They have better data than any of us and I will use their actions as an indicator.

Next week’s Unemployment Report is an intermediate data point that will be scrutinized as analysts try to gauge the impact of housing. This is a time to keep your powder dry. I have been buying commodity stocks on dips and taking profits. That has been working out well. Also consider selling OTM put spreads on these stocks.

Have a great holiday!Daily Bulletin Continues...