Stock Option Trading Strategy – Keep your size small and stay long energy calls and bull put spreads

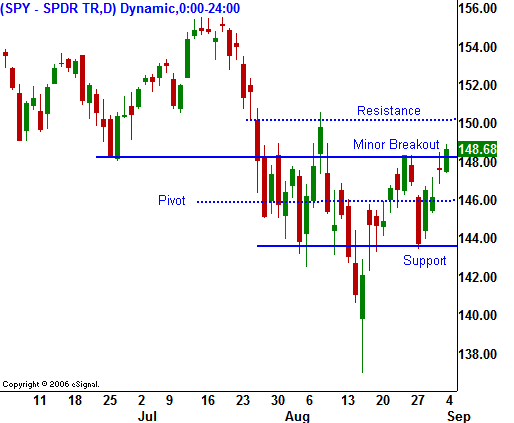

Today the market is picking up where it left off Friday. Last week we saw volatile trading and a midweek sell off was met by strong demand for stocks on Thursday and Friday. The SPY is back above 146 and that noose is tightening around the necks of many bears. This morning, "merger Monday” and end of month/beginning of the month fun buying is pushing the market higher. In today's chart you can see the 146 level and the minor resistance level that was just broken just above SPY 148.

.

.

Traders are returning from vacation and they won't have long to get their bearings. The first big piece of economic information will be released Wednesday at 1:00 p.m. CST. The Beige Book will provide valuable insights on economic activity across the nation. Friday, the Unemployment Report will be released.

Many bears are arguing that the Fed does not have its finger on the pulse of the economy. They fear that if these statistics reflect economic stability, the Fed won't ease and a recession will be inevitable. Consequently, it is possible that the market will react negatively to data that might otherwise seem positive.

Conversely, if there are signs of an economic slowdown the market could rally based on the belief that the Fed will lower rates at least a quarter-point when they meet in two weeks.

I want to see economic stability and I hope the Fed does not lower rates. This scenario will create a sell off and I will view it as a buying opportunity. By staying the course, the Fed will be signaling signs of economic strength. My interpretation will be that they feel the economy is strong enough to absorb weakness in the housing sector and that a recession is unlikely. The Fed has already mentioned that they are on high alert and they are willing to assist if needed. They are gathering data from new sources and they are polling corporations to gauge economic strength. I believe they do have their finger on the pulse and they will act accordingly.

If the Fed lowers interest rates, I will be concerned about an economic slowdown and I will be looking for future shorting opportunities.

Keep your powder dry ahead of these events. Stay long energy stocks. They have been a nice trading safe haven.

.

Traders are returning from vacation and they won't have long to get their bearings. The first big piece of economic information will be released Wednesday at 1:00 p.m. CST. The Beige Book will provide valuable insights on economic activity across the nation. Friday, the Unemployment Report will be released.

Many bears are arguing that the Fed does not have its finger on the pulse of the economy. They fear that if these statistics reflect economic stability, the Fed won't ease and a recession will be inevitable. Consequently, it is possible that the market will react negatively to data that might otherwise seem positive.

Conversely, if there are signs of an economic slowdown the market could rally based on the belief that the Fed will lower rates at least a quarter-point when they meet in two weeks.

I want to see economic stability and I hope the Fed does not lower rates. This scenario will create a sell off and I will view it as a buying opportunity. By staying the course, the Fed will be signaling signs of economic strength. My interpretation will be that they feel the economy is strong enough to absorb weakness in the housing sector and that a recession is unlikely. The Fed has already mentioned that they are on high alert and they are willing to assist if needed. They are gathering data from new sources and they are polling corporations to gauge economic strength. I believe they do have their finger on the pulse and they will act accordingly.

If the Fed lowers interest rates, I will be concerned about an economic slowdown and I will be looking for future shorting opportunities.

Keep your powder dry ahead of these events. Stay long energy stocks. They have been a nice trading safe haven.

.

Traders are returning from vacation and they won't have long to get their bearings. The first big piece of economic information will be released Wednesday at 1:00 p.m. CST. The Beige Book will provide valuable insights on economic activity across the nation. Friday, the Unemployment Report will be released.

Many bears are arguing that the Fed does not have its finger on the pulse of the economy. They fear that if these statistics reflect economic stability, the Fed won't ease and a recession will be inevitable. Consequently, it is possible that the market will react negatively to data that might otherwise seem positive.

Conversely, if there are signs of an economic slowdown the market could rally based on the belief that the Fed will lower rates at least a quarter-point when they meet in two weeks.

I want to see economic stability and I hope the Fed does not lower rates. This scenario will create a sell off and I will view it as a buying opportunity. By staying the course, the Fed will be signaling signs of economic strength. My interpretation will be that they feel the economy is strong enough to absorb weakness in the housing sector and that a recession is unlikely. The Fed has already mentioned that they are on high alert and they are willing to assist if needed. They are gathering data from new sources and they are polling corporations to gauge economic strength. I believe they do have their finger on the pulse and they will act accordingly.

If the Fed lowers interest rates, I will be concerned about an economic slowdown and I will be looking for future shorting opportunities.

Keep your powder dry ahead of these events. Stay long energy stocks. They have been a nice trading safe haven.

.

Traders are returning from vacation and they won't have long to get their bearings. The first big piece of economic information will be released Wednesday at 1:00 p.m. CST. The Beige Book will provide valuable insights on economic activity across the nation. Friday, the Unemployment Report will be released.

Many bears are arguing that the Fed does not have its finger on the pulse of the economy. They fear that if these statistics reflect economic stability, the Fed won't ease and a recession will be inevitable. Consequently, it is possible that the market will react negatively to data that might otherwise seem positive.

Conversely, if there are signs of an economic slowdown the market could rally based on the belief that the Fed will lower rates at least a quarter-point when they meet in two weeks.

I want to see economic stability and I hope the Fed does not lower rates. This scenario will create a sell off and I will view it as a buying opportunity. By staying the course, the Fed will be signaling signs of economic strength. My interpretation will be that they feel the economy is strong enough to absorb weakness in the housing sector and that a recession is unlikely. The Fed has already mentioned that they are on high alert and they are willing to assist if needed. They are gathering data from new sources and they are polling corporations to gauge economic strength. I believe they do have their finger on the pulse and they will act accordingly.

If the Fed lowers interest rates, I will be concerned about an economic slowdown and I will be looking for future shorting opportunities.

Keep your powder dry ahead of these events. Stay long energy stocks. They have been a nice trading safe haven.Daily Bulletin Continues...