Stock Option Trading Strategy – Long calls on energy stocks and short bull put psreads.

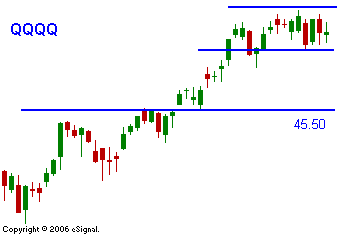

Before the open the market looked like it was going to take a breather. Overseas markets were soft and the S&P 500 was trading lower. Then, the CPI came in at .2% for April when economists were expecting .5%. The market had a very positive reaction and if inflation is contained, the Fed might be able to react to a weakening economy. As I've said before, the economic numbers will cause knee-jerk reactions. The market wants to grind higher and if it can generate a little momentum, option expiration trading could "goose" it higher. If traders feel that an intraday directional move is unfolding, they will leg out of hedged positions and add a little kicker to their bottom line. That scenario is possible today. The A/D ratio is a positive 2:1. There is little that can stand in front of this rally and the market is likely to march higher the rest of the day. As you can see in today's chart, tech stocks are in a tight trading range. They have not been as strong as the big caps. If the QQQQs breakout, they could go on a run. My energy stock call positions are fairing well and many of my bull put spreads will expire this Friday. After expiration I will be waiting for a pullback. At that time I will consider taking on a few more long call positions.

Daily Bulletin Continues...