Stock Option Trading Strategy – Long bull put spreads, lightening up on energy stock call options.

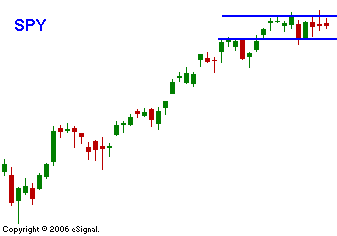

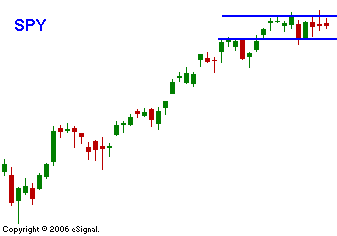

Overnight the markets did not have much information to digest. The Asian markets were flat and the European markets were down slightly. Yesterday the market got a shot in the arm from a lower than expected CPI number. That boost pushed prices higher right from the open. During option expiration week that impetus should have been enough to initiate bullish program trading, especially when the market has been in such a strong uptrend. That was not the case and to my surprise, the market reversed and closed lower for the day. In the absence of news, choppy trading should be expected. The path of least resistance might be higher, but no one wants to buy the top. The bears don't dare to short at this level, but some bulls might be ready to take profits. In the chart you can see that a resistance line has formed. There is also minor support at SPY 149.50. Keep your positions small during this directionless period. My gut tells me that we might see an afternoon drift lower. My bull put spreads are working out well and many will expire Friday. If we pull back, I will look to add June put spreads once support is found. I might consider taking some long call positions as well. I still like the energy stocks, but I'm taking profits on some of my call positions. Oil feels toppy and I feel that I might be able to get in at a lower price.

Daily Bulletin Continues...