Tuesday’s Stock Option Trading Strategy!

The stock market is weak on earnings and economic news. There will be some earnings call option trading opportunities, but you need to tread carefully since the intermediate market trend is bearish.

Yesterday, the market bounced on IBM's earnings pre-announcement. The news was good and they couldn't wait to share it. The market responded positively and it negated Friday's losses. Overseas markets were weak heading into the Monday, but that move was largely attributed to our decline on Friday.

This morning, overseas markets were very weak again. Japan was down 1%, Hong Kong was down 2.4% and the Shanghai composite fell 1%. Clearly these markets did not buy into our bounce yesterday. That weakness set a negative tone before the market opened today.

That negative tone was exacerbated by weak earnings from Citigroup. They posted their largest loss ever and write downs continue to surface. Last week I heard many analysts saying that the financial sector might finally represent a buying opportunity. As you know from my comments, I disagree. The damage will take many months to discover and I do not believe we have seen the lows. Before this sector is a buy, it needs to form a longer-term base. Currently, it has not even stopped going down. The XLF is down today and it is close to its 52 week low. Analysts keep referring to the "kitchen sink" quarter where all of the questionable write-downs will be taken so that the damage can be assessed. From my perspective, the whole kitchen has already been gutted. Now we will wait to see if the damage has spread to other parts of the "house".

How can you take aggressive write downs when you still don't know how far this crisis will spread? There are "good loans" that could default in the next few months if the unemployment rate continues to rise.

Yes, our financial institutions are attracting sovereign investments and analysts keep referring to this as a big positive. Personally, I believe these investors want to unload their US dollar holdings and they would rather place their money in a company than in the hands of our government. Those investments are coming from our largest creditors (China and the Middle East). Our currency is devaluing and that will continue as long as the Fed continues to lower interest rates. In Europe, the interest rates are relatively high (England and the ECB are not going to ease) and the currency is strong.

The PPI came in at a reasonable rate and core inflation only rose .2%. Last month's number was not revised lower. I thought this news was positive for the market; however, retail sales were released at the same time. They showed a .4% decline in December and a flat number was expected. Furthermore, the robust sales readings from November were revised lower.

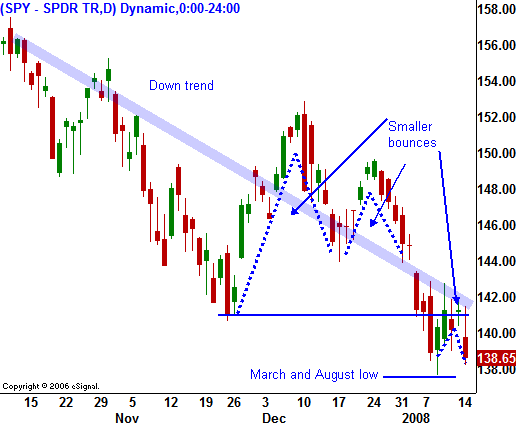

The rest of the week we will continue to get news from financial stocks. This negative setting and option expiration sell programs could push the market to new relative lows. In the chart you can see that each subsequent bounce has been smaller and now the market is going to retest the lows from last March and August.

As I have been mentioning my longer-term option trading strategy is to buy put diagonal spreads. Short-term, I still believe there will be pockets of strength within the market. Cyclical stocks have been pounded hard and I particularly like companies that generate more than half of their revenues overseas. Heavy machinery and construction stocks fall into this category. You must be careful in picking these earnings plays. I am favoring February at the money call options. The long-term uptrend still needs to be in place and the earnings guidance from last quarter needs to be positive. I will try a few of these plays early in the earnings season, and if they are not working, I will pull the plug. If my theory is correct I will continue to look for similar situations.

The market is transitioning, the highs from last year will hold through 2008 and I believe you need to be prepared to sell rallies during the first six months of this year. For today, I believe the market will continue to drift lower and expiration related sell programs will push it down this afternoon.

Daily Bulletin Continues...