Full Steam Ahead – Bears Won’t Stand In The Way!

A week ago, the market staged a one-day decline that spooked many investors. The Chinese market had declined 5% overnight and it had fallen 20% in two weeks. They have been the cornerstone to this global economic recovery and traders want to see continued strength.

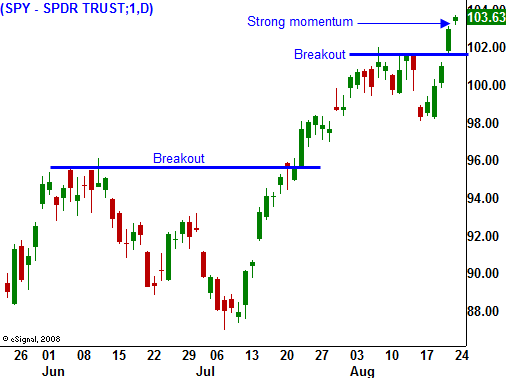

As it turns out, that drop was nothing more than profit-taking. As the week progressed, the market recovered and "less bad" economic releases ignited buying. Retail stocks were bracing themselves for dismal results and the numbers came in better than expected. By the end of the week, option expiration also played a factor in pushing the market higher. Once a new relative high was established, another round of short covering pushed us to a new high for 2009.

There hasn't been much news over the weekend and traders are viewing at as a positive. Momentum from last week has bears running for cover and the path of least resistance is higher.

Interest rates are low, earnings have exceeded expectations, economic news is "less bad" and inflation is not a concern. The Fed supports low interest rates and earnings season is over. The two big numbers this week are durable goods and GDP. I expect both to have a positive influence on the market. Congress is on vacation and we don't have to worry about any new plans or proposals.

In light summer trading, we should be able to grind higher this week. I still like selling out of the money put spreads on strong stocks and keeping my distance. I am adding positions today, but I won't get aggressive until I see a pullback. At this juncture, I just want to get a few trades on the books. Keep your size small and don't chase.

For today, the A/D is a positive 2 to 1 and the market has fallen into a very tight trading range. I expect a quiet day with a positive bias.

Daily Bulletin Continues...