Generate Income And Keep Your Size Small While You Wait For The Next Big Decline

The current situation reminds me of a period from the middle of 2007 to the middle of 2008. Many analysts were forecasting a credit crisis, but there weren't any "dead bodies" and no one knew when the storm might hit. During that time, the market was in a general decline, but there were many decent rallies.

Earnings were good, employment was solid and the economic news was stable. On the surface, everything was fine and nerves were easily calmed when bullish news hit the market. Once Countrywide and IndyMac failed, the tone changed and sustained selling began.

We are currently at a similar juncture. The market has rebounded from its recent lows. Earnings have been good and interest rates remain low. Economic news has been generally good, although there are signs that the recovery is slowing. This morning, initial jobless claims were disappointing and 470,000 applications were filed last week. That is 30,000 more than analysts had projected. PPI came in "hotter" than expected and inflation could be a future concern. The Philly Fed and Leading Economic Indicators came in slightly better-than-expected. On the surface, everything looks fine and the market wants to move higher.

The credit problems in Europe don't present an imminent threat - yet. Greece is getting all of the attention because it is a microcosm of the entire EU. For decades, Greece has spent beyond its means. Budget deficits are huge and it needs to roll over (refinance) its debt. Investors are nervous and the default risk is very high. Greece has not been able to raise capital and it needs assistance. The EU is evaluating the situation and they demand that drastic cost-cutting procedures be taken immediately. If the EU is not satisfied with Greece's attempt to balance its budget, assistance will be denied. Government spending will be slashed, wages will be cut and retirement benefits will be postponed. Laborers are protesting and they are prepared to strike.

Germany (the largest EU member) could provide aid but it is reluctant to. They have their own issues and citizens don't want to bail out a country with reckless spending habits.

Greece is just the tip of the iceberg. It only accounts for 2% of Europe's GDP. Spain is also close to a credit crisis and it accounts for 12% of Europe's GDP. They have a 20% unemployment rate and conditions are deteriorating quickly. Portugal, Ireland, Italy, Bulgaria, Latvia, Lithuania and England are in bad shape. This problem could easily spread to other countries.

As we saw last year, credit markets affect the stock market. When banks freeze up, businesses and consumers can't access the money they need.

When a government fails, the ripple effect is huge. Banks, pension funds and governments hold sovereign debt and they are lucky to get $.20 on the dollar. Once the first country goes, investors wonder which one is next. Credit tightens up immediately and it forces the next failure. Banks start to evaluate counterparty risk and if they feel a financial institution has a great amount of exposure they will stop transacting business with them. This should all sound familiar. It's exactly what happened last year. Unfortunately, when countries are involved, the fallout is much greater.

This might all sound like a bunch of gloom and doom, but the problem is very real. When your debt reaches extreme levels, you can't afford to make your interest payments or meet payrolls. Tax revenues are down because of unemployment. Transfer payments (unemployment compensation, welfare) are up because citizens are drawing benefits. Retirement benefits are increasing because people are living longer and new citizens are eligible. Greece is very close to the breaking point.

This problem is not unique to Greece or the EU, it is happening right here in the US. We just happen to have 5 more years of cushion than they do (partly because we don’t have a national healthcare program).

The bottom line is this. The market can chop back and forth and rally on good news, but know that a major decline lies ahead. I don’t know if it will happen in the next month or the next six months, but it draws closer every day.

When this credit crisis comes to a head, stock valuations won’t mean a thing. We will fall into a steady decline and it might make last year look like a cake walk. Europe and the US fired all of the silver bullets and we are painted into a corner. The measures we took last year have been exhausted and the Fed Funds Rate is already at 0%.

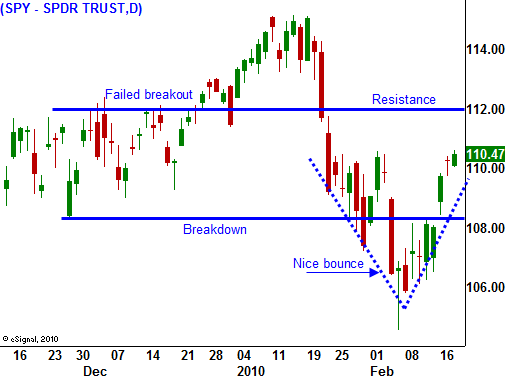

So here’s how to trade it. The cross currents should keep us in a trading range for at least a month. Sell out of the money call credit spreads on weak stocks and sell out of the money put spreads on strong stocks. Keep your size small and generate income while you wait. Look back at the last financial crisis and start lining up your shorts. Place orders to buy puts when the stocks break support on a GTC basis. When the next wave of selling hits, you won’t have time to place orders.

Daily Bulletin Continues...