End-of Month Fund Buying and Bullish Employment Projections Have Provided A Lift!

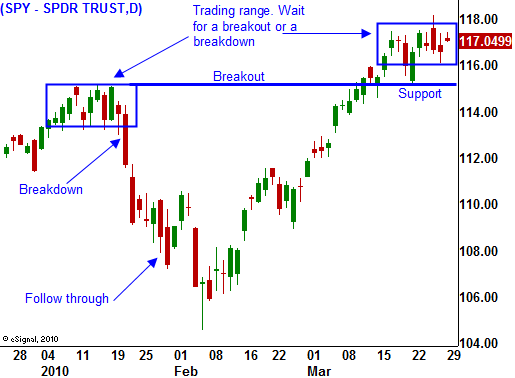

In the last nine trading days, the market has been caught in a tight low-volume trading range. It broke through resistance at SPY 115 and now it is waiting for information. We are in what I consider to be "no man's land". We need to wait for a follow-through rally or a reversal.

Option implied volatilities are very low and it does not make sense to sell credit spreads. The momentum has stalled and prices could go either way. Wait for the market make its next move and then buy puts or calls.

My gut tells me that we are heading higher. Traders want to focus on "knowns" like earnings, balance sheets, low interest rates and decent economic releases. They are discounting "unknowns" like the potential for a credit crisis in Europe.

Unemployment will be the focal point this week. Wednesday, we get the ADP employment index. Thursday, initial jobless claims will be released. Friday, the Unemployment Report will drive the market. Consensus estimates are very high and analysts expect jobs to grow by 200,000. If you ignore the blip into positive territory last November, this would be the first increase in jobs in a year and a half. Seemingly, the market should rally off of such a strong number.

It really depends on where the jobs are coming from. The government will be hiring 200,000 temporary census workers in the next month or two. That will provide a short-term boost, but traders will see right through it. The jobs need to come from organic growth. Corporations have been reluctant to hire and if their mood is changing, it would be a big positive for the market.

If we do see organic job growth over a period of months, the market will rally. The first positive report or to could spark concerns of higher interest rates and that could provide a stiff head wind. On a longer-term basis, this would be a big positive for the market. The Fed will have to act quickly to unwind quantitative easing so that inflation does not become an issue. We are walking a tight rope. Higher interest rates will dramatically increase our cost of capital and the interest expense on our national debt will skyrocket. As long as tax revenues keep pace in a growing economy, this will not be an issue.

The Fed Chairman is not very optimistic and employment is a concern. He is perplexed by the slow recovery in jobs. Corporations have streamlined operations and increased productivity. They do not want to rehire and add to their overhead. I believe headcounts are being increased overseas where wages are lower and growth is higher.

As the year wears on, federal stimulus will wane. The programs are up and running and this will not be a source of new jobs. State and local governments will be cutting staff as funds run out. For example, in Illinois 1400 State Troopers will lose their jobs in the next year. Cuts like this are happening in every state right now! This trend will offset job gains in other economic areas.

Illinois is proposing a 50% tax hike on personal income, Minnesota plans to tax manicures and tattoos, Maine is planning a clown tax, California will legalize pot to generate revenue and they plan to tax Amazon sales. The bottom line is that states are out of money and they are desperate. Higher taxes will hurt consumption.

From 2000 – 2003, all 50 states collectively amassed $250 billion in deficits during the 4-year recession. In just one year (2009), they have already gone $300 billion in the red.

Ten years ago, we had a silver bullet. People had equity locked up in their homes. They tapped into it through refinancing and we spent our way out of that recession in 4 years. This time around, we don’t have that crutch.

I don't see sustained organic growth as a likely scenario and I do not believe in the “V” recovery. The market was oversold last March, and now it is overbought. Severance packages are running out and people will cut back on consumption. Unemployment benefits are also running out and Congress failed to extend benefits for 750,000 people. Baby boomers have not saved for retirement and last year's scare has them saving. Consumption drives 70% of our economy and Europe is in a similar situation.

Emerging markets have great growth potential, but those populations do not have enough wealth to pull the money centers of the world out of a recession.

Bears are not aggressive and their shorts have been covered. No one wants to stand in front of this freight train. That is why you do not see big volume spikes on the rallies. Furthermore, Asset Managers are not aggressively bidding for stocks. They do not feel that they will miss the next big rally. There is very little information to trade off of and there is a lack of selling. This market is just drifting higher on little or no volume.

Option premiums have fallen to an 18-month low. Speculators and hedgers are not buying put premium. This means confidence is high.

In the next 4 months, the PIIGS will be issuing €400 billion of debt. These auctions could go poorly and I expect to see a sharp market reversal.

End-of-month (end-of-quarter) fund buying and optimism ahead of this week's employment statistics should fuel a rally. Limit the number of positions and keep your size small. Buy calls in tech and retail. Take profits and sell into strength. The big money making opportunity will come on the reversal. Be patient and know that this is the move we are waiting for.

Daily Bulletin Continues...