We Have the Intra-Day Reversal. Sell Out of the Money Put Credit Spreads On Strong Stocks!

In the last two weeks, we have witnessed panic selling. The market has largely discounted the European credit crisis to this point and now it is getting the attention it deserves.

Once the market broke major technical support levels, hedge funds were forced to unload positions. Commodity stocks were hit hard and they were liquidated to meet margin calls.

Hedge funds have been short U.S. Treasury's and long commodity stocks (dollar carry trade). When treasuries rallied and commodity stocks dropped, they had to unwind positions. This is similar to the price action we saw in the fall of 2008. Furthermore, China relies on European demand and it exports a large percentage of its GDP to those nations. A slowdown in the EU would impact China. They are the major global consumer of commodities and traders are expecting demand decline.

Financial stocks were also battered. Major US banks have exposure in Europe. If the credit crisis spreads, the banking system could lock up like it did a year ago. Counter party risk will keep them from doing business with each other. Banks could also be hit with a wave of write-downs from sovereign debt holdings.

The threat of a double dip recession also exists. Financial institutions are straddled with toxic assets and those write-downs could increase. Yesterday's initial jobless claims came in at 471,000. That was much higher than expected and the four-week moving average is increasing. This means unemployment could start to grow.

The financial reform bill was passed by the Senate yesterday. This has also been weighing on financial stocks. As expected, banking activities will be restricted and profit margins will decline. This was largely expected and now that the details are known, financial stocks might rebound temporarily.

The market is extremely oversold. Option implied volatilities have spiked and we are due for a bounce. Traders will not want to go home short for fear that a major announcement from Europe could be forthcoming. The Eurodollar has also been destroyed in the last few weeks and we are due for a short covering rally in the currency. Even if the Eurodollar stops declining, the market will rebound.

Let us not forget that earnings are fantastic, balance sheets are strong and interest rates are low. These forces pushed the market higher and there are Asset Managers who feel that we are in the "sweet spot". They will bid for stocks once support has been established. This line of thought has a major flaw. The financial foundation is cracked and the wealth centers of the world are straddled with debt.

We are in the early stages of a long-term decline. This means that we will see snap back rallies. Greece has not defaulted (yet) and there will be those who think it will not happen.

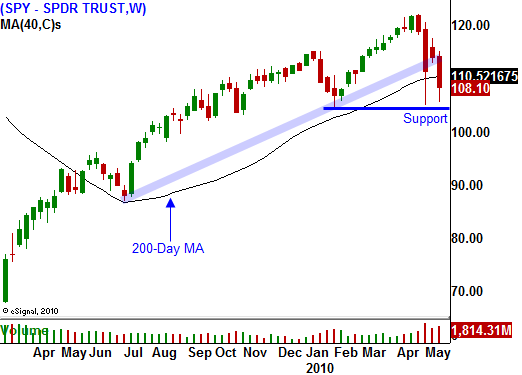

Stocks have rebounded from early lows this morning and this could be the intraday reversal we have been looking for. We retested the lows from February and they are likely to hold on a short-term basis. Take profits on put positions and wait for the rally to stall before you reenter.

First resistance is at SPY 112 and major resistance lies at SPY 115. I took profits on all of my put positions yesterday. I am selling out of the money put premium on strong stocks today. When the rally stalls, I will buy back my short put positions. The decline in implied volatility alone will make this a worthwhile trade.

In coming weeks, I will look to sell out of the money call credit spreads in June and I will be buying far out of the money September puts on stocks. I believe the next wave of selling will be controlled and sustained. Stocks that were hit hard during last year's credit crisis will be of particular interest. Cyclical stocks that depend on credit or whose customers depend on credit will make good long-term shorting candidates.

Take profits on put positions and be ready to reestablish them in the next week or two.

Daily Bulletin Continues...