Elections Turned Out As Expected. The FOMC Is Likely To Disappoint!

After all of the hype and drama, the elections turned out just as the market had expected. The reaction has been worthy of a giant yawn as stocks flat line. Another major piece of news will be released in a matter of hours.

At 2:15 pm Eastern time, the FOMC will release its statement. On average, analysts believe that $500 billion will be injected into our financial system. The Fed knows it is treading on thin ice. It is just about out of bullets and this last act of desperation needs to be prolonged. I believe they will start QE2 at a much lower level and the market won't initially like the news. In a matter of days, traders will start looking for the next injection and the market will recover.

Printing money has unintended consequences and it is a risky proposition. First of all, this is an exercise in futility. Interest rates are at historic lows and they are not stalling our economic recovery. When we buy our own bonds (print money) we devalue the dollar. Our trade deficit is huge and this means the cost of our imported goods will increase and inflation will become an issue. Secondly, we will be buying our bonds at very high prices. As interest rates increase, the value of our bond holdings will plummet. When we eventually unwind the positions, we will incur huge losses.

In theory, interest rates will rise because the economy is improving. Bond losses will be offset by higher tax revenues as the GDP grows. In reality, we could easily be faced with stagflation. Our economic recovery has benefited from an inventory rebuild and demand is soft. A weak dollar will result in inflation and that will push interest rates higher. We will incur huge losses in our bond holdings and we will not have the benefit of higher tax receipts.

For every $1 trillion the Fed injects into our financial system, GDP will grow about .25%. The risk is high and the reward is low. Unfortunately, our government can't stop meddling.

The economic news this week has been encouraging. ISM manufacturing and ISM services both exceeded expectations. This morning, ADP employment showed that 40,000 private sector jobs were added. They have "undershot" the government's number four straight months and there is a chance that Friday's Unemployment Report will be much better than expected (zero job growth). Last week, initial jobless claims improved dramatically and employment could be showing signs of life.

We are more than halfway through this earnings cycle and the results have been excellent. More than 80% of the companies have exceeded earnings estimates. Stocks are cheap relative to bonds and money should rotate from fixed income into equities. Trim Tabs reported that money flowed into equities (mutual funds) in October for the first time in months. Asset Managers have wanted to buy stocks, but they won't chase. The market rocketed higher in September and October without a pullback. They are anxiously looking for an entry point and they do not want to miss a year-end rally.

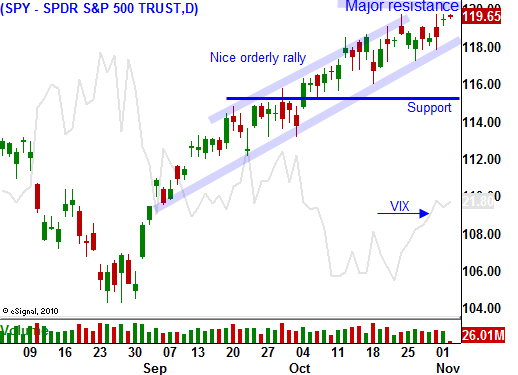

I believe that any substantial market decline will find support. The first level to watch is SPY 115. That is a major horizontal support level and it should hold. SPY 113 is also significant and I believe that is the lowest level we could see.

The time to be cautious is when bullish sentiment is through the roof and option premiums are cheap. It signals that no one is worried about a decline That is not the case now. Option implied volatilities are on the rise and you can see that in today’s chart. Investors are buying protection (puts) ahead of major news and this should help to contain any decline. Money has been flowing into bonds for many months and it reflects a high degree of pessimism as investors park money on the sidelines.

Growth in China remains strong and credit concerns in Europe have subsided. These are the potential spoilers for this rally and they need to be monitored closely.

Look for selling this afternoon. Stocks are retreating and the election results were already priced in. A wimpy round of quantitative easing by the Fed will also weigh on the market this afternoon. Profit-taking will set in and bears will probe for support. I do not advise shorting this market unless you are VERY nimble. You need to watch prices on a minute-to-minute basis since a snap back rally can come at anytime. If stocks really fall apart, a nice buying opportunity might present itself ahead of Friday’s number.

Be patient and stay on the sidelines. When support is established, start scaling into long positions..

Daily Bulletin Continues...