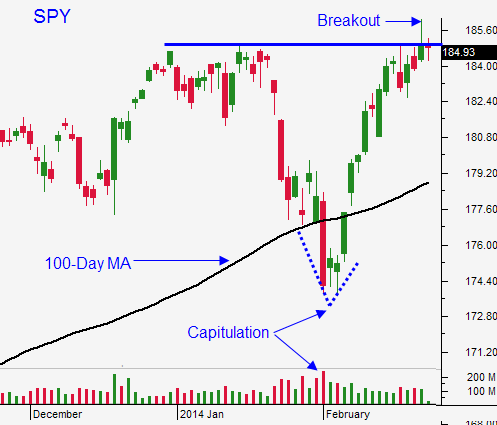

Market Makes A New All-time High. SPY Got Above $185 and It Closed Near the High

In February, we nailed the capitulation low at SPY $173.60. The S&P rallied 80 points and we took profits. We gradually scaled back into calls and we got the close above $185 yesterday. If you followed my advice, you made a lot of money. I put a few hours into this research each day and all I ask for in return is a review. Your comments and success inspire me to keep doing this. Please CLICK HERE and post a review on Investimonials.

Yesterday, the market broke out to a new all-time high. “Fed Speak” propelled the move and we closed near the high of the day. On the surface, this move looked constructive, but it lacked the energy I was hoping for.

Janet Yellen delivered a clear message and she instills confidence. She mentioned that a substantial economic decline would be needed for the Fed to postpone tapering. That message was consistent with the FOMC minutes and the market seemed comfortable with it.

This was the last good round of news for the next few days. To this point, traders have been willing to give weak economic data a free pass due to bad weather.

Durable goods orders came in light and initial jobless claims inched higher. This morning, GDP came in at 2.4% and that was lower-than-expected.

On Monday, ISM manufacturing will be released. This number missed by a substantial amount a month ago and it has the potential to spark profit taking. Official PMI's will also be released over the weekend. Growth in China has been slipping and that has overshadowed the recovery in Europe.

As the news gets "heavy", Asset Managers will get tired of supporting the market and they will pull bids. No one feels as though they are going to miss the next big rally.

Bullish speculators (myself included) have been lining up ahead of the breakout. Some waited until the actual event and they piled in yesterday. When the news gets “heavy” next week, Asset Managers will back off and we could hit an air pocket. That move will flush out bullish speculators and it will set up a better entry point.

Do not construe my statement as being bearish. I am simply looking for a swift pullback that runs its course in a few days. The macro backdrop is still very bullish.

I am long calls. I mentioned yesterday that I needed to see a rally above SPY $185 and a close near the high of the day. We got it and I am making money. However, I have raised my stop to SPY $185. A follow-through rally today would build confidence and it will provide me with a nice cushion.

If I am flushed out of my positions, I will lock in profits. A dip would present an excellent buying opportunity. If we do pullback next week, I will be ready to jump back in.

Stay long and be cautious. Move your stops up.

We have seen late day selling and the price action in the last hour will be very telling. If we rally, we could be in nice shape next week. A decline would suggest that an air pocket lies ahead.

The price action this morning looks good. Let's hope for a nice steady grind higher.

.

.

Daily Bulletin Continues...