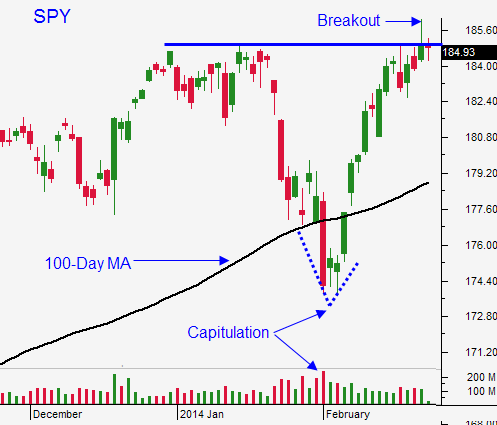

If The SPY Does Not Close Above $185 Today – Go To Cash. Yellen Needs To Spark Buying

The market is within striking distance of the all-time high, but it does not have the strength to break out. Every rally is accompanied by late day selling and we are caught in a range. If the market does not close above SPY $185 today, I am exiting my call positions.

Don't construe my actions as bearish. I've given the market plenty of time to break out and it needs to gather strength. Buyers are not engaged at this level and we might need to hit small air pocket to get them back in the game.

This is a five-week expiration cycle and the first week is typically boring. The news dries up and the market chops back and forth. Bullish speculators (myself included) are lined up waiting for the breakout. When it fails to materialize, they start to exit. Buyers pull their bids and we hit an air pocket.

If Janet Yellen can't spark a rally today, it is time to go to cash. Any decline will be brief and shallow.

Domestic economic releases have been light, but the market has been willing to give the data a free pass. Horrible weather conditions have created an economic soft patch. Durable goods orders were little light today and initial jobless claims inched higher. Next week we will get ISM manufacturing, ISM services, ADP and the Unemployment Report. Official PMI's will also be released. Another round of weak news could spark profit taking.

Option traders need momentum and I am not feeling it right now. If the market stages a breakout today and it closes above $185, I will stick with my call positions. A close near the high of the day would be icing on the cake.

If I am forced out of my positions, I can evaluate from the sidelines. Ideally, we will get a dip next week and I will be able to enter at better levels. Should the market breakout, I will not hesitate to buy on strength. If that happens, the momentum will be reestablished and I can get long with confidence.

Global economic conditions are good. Weakness in China has been offset by strength in Europe. The PBOC will jump into action if conditions in China deteriorate. Domestic economic conditions have been decent. With each passing week the weather will have a smaller impact. I sense that there could be pent-up demand.

Earnings have been excellent and cash flows are at record levels. Companies are using that cash for M&A's and buybacks.

Interest rates are low and tapering will continue. This is a good combination. I know that some bond analysts say that the drop in rates is a bearish sign. Personally, I feel that yields got ahead of themselves when tapering was announced and now they are correcting. Tapering does not mean tightening and the Fed will keep its zero rate interest policy (ZRIP) in place through 2015.

The debt ceiling has been extended and Obamacare will be delayed for small businesses. This is bullish.

The Ukraine is grabbing the headlines, but I would not be overly concerned.

I am long calls and I need to see a breakout today. If Janet Yellen can't spark a rally, I will exit my positions and watch from the sidelines.

I sense that an excellent buying opportunity lies ahead. Be prepared to buy a dip or a breakout.

.

.

Daily Bulletin Continues...