Major Economic News Next Week. We Need To See Pent-up Demand

Posted 11:00 AM ET - Yesterday the market rallied after a decent durable goods number. A positive tone was set by overseas markets. The path of least resistance is up.

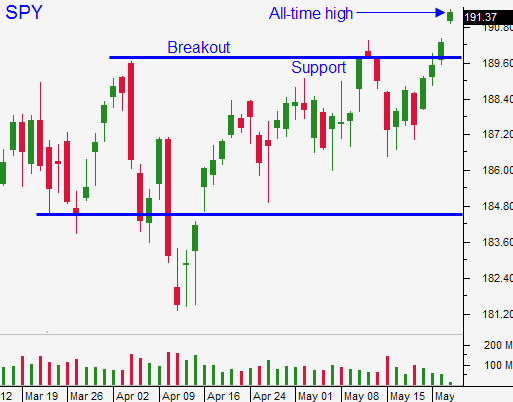

Bulls have momentum on their side and the market has broken out to a new all-time high. The level of conviction is low and trading volumes are light. We are in a news vacuum and we won't get anything substantial until Monday.

Last week's flash PMI's were better-than-expected. I believe China's number is playing a key role in this breakout. Economic conditions are fragile and there are rumors that the PBOC will lower bank reserve requirements twice before the end of the year. Fiscal spending programs have yet to kick in.

European markets are trending higher. The ECB will meet on June 5th and most analysts expect them to ease. This will push yields into negative territory and savers will have to pay banks to keep their money. It will be interesting to see the unintended consequences that develop.

ISM manufacturing, ISM services, ADP and the Unemployment Report will be released next week. Analysts have been looking for signs of pent-up demand and we have yet to see that. Retailers have posted dismal results and the guidance has been gloomy.

Interest rates are at historic lows and that suggests a flight to safety. The Fed said that they could extend tapering and introduce other tightening measures before the tapering ends. This would theoretically make the transition to higher rates a little smoother.

If we see signs of pent-up demand next week, we will have a legitimate breakout. If the numbers are marginal, we will fall into the summer doldrums. This island of news will have to fuel us until earnings season in July.

I am day trading and I sold some put spreads last week. I can't fully embrace this light volume rally. I need proof that economic conditions are improving.

Buy a few calls and keep your size small. Use a close below SPY $190 as a stop.

.

.

Daily Bulletin Continues...